Page 45 - BANKING FINANCE SEPTEMBER 2015

P. 45

ARTICLE

riod of study. This signifies that State Bank of Patiala and Table 6 shows that calculated F value of 0.414 which is

State Bank of Bikaner and Jaipur focuses more on recov- very much lower than table value or critical value of 2.87

ery of personal loans as compared to other banks due to at 5 per cent level of significance with 24 degrees of free-

their high percentage of NPA. dom ( v1=4 and v2=20) and hence there is no significant

difference in gross NPA ratios of SBI associated banks.

Table 5: Gross Non-Performing Assets to Gross This shows that all SBI associate banks have performed

Advances evenly in management of NPAs.

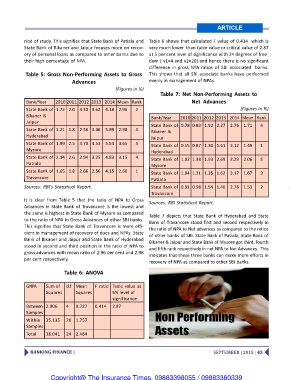

(Figures in %) Table 7: Net Non-Performing Assets to

Net Advances

Bank/Year 2010 2011 2012 2013 2014 Mean Rank

(Figures in %)

State Bank of 1.72 2.0 3.30 3.62 4.18 2.96 2

Bikaner &

Jaipur Bank/Year 2010 2011 2012 2013 2014 Mean Rank

State Bank of 1.21 1.8 2.56 3.46 5.89 2.98 3 State Bank of 0.78 0.83 1.92 2.27 2.76 1.71 4

Hyderabad Bikaner &

Jaipur

State Bank of 1.99 2.5 3.70 4.53 5.54 3.65 5 State Bank of 0.55 0.87 1.30 1.61 3.12 1.49 1

Mysore Hyderabad

State Bank of 2.14 2.6 2.94 3.25 4.83 3.15 4 State Bank of 1.02 1.38 1.93 2.69 3.29 2.06 5

Patiala Mysore

State Bank of 1.65 1.8 2.66 2.56 4.35 2.60 1 State Bank of 1.04 1.21 1.35 1.62 3.17 1.67 3

Travancore Patiala

Sources: RBI's Statistical Report. State Bank of 0.91 0.98 1.54 1.46 2.78 1.53 2

Travancore

It is clear from Table 5 that the ratio of NPA to Gross Sources: RBI Statistical Report.

Advances in State Bank of Travancore is the lowest and

the same is highest in State Bank of Mysore as compared Table 7 depicts that State Bank of Hyderabad and State

to the ratio of NPA to Gross Advances of other SBI banks. Bank of Travancore stood first and second respectively in

This signifies that State Bank of Travancore is more effi- the ratio of NPA to Net advances as compared to the ratios

cient in management of recovery of dues and NPAs. State of other banks of SBI. State Bank of Patiala, State Bank of

Bank of Bikaner and Jaipur and State Bank of Hyderabad Bikaner & Jaipur and State Bank of Mysore got third, fourth

stood in second and third position in the ratio of NPA to and fifth rank respectively in net NPA to Net Advances. This

gross advances with mean ratio of 2.96 per cent and 2.98 indicates that these three banks can make more efforts in

per cent respectively. recovery of NPA as compared to other SBI banks.

Table 6: ANOVA

GNPA Sum of d.f Mean F ratio Table value at

Squares Squares 5% level of

significance

Between 2.906 4 0.727 0.414 2.87

Samples

Within 35.135 20 1.757

Samples

Total 38.041 24 2.484

BANKING FINANCE | SEPTEMBER | 2015 | 45

Copyright@ The Insurance Times. 09883398055 / 09883380339