Page 41 - The Insurance Times August 2024

P. 41

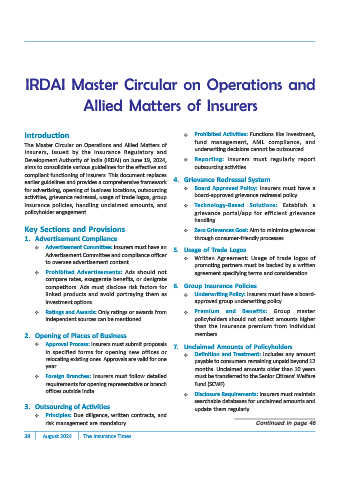

IRDAI Master Circular on Operations and

Allied Matters of Insurers

Introduction Prohibited Activities: Functions like investment,

fund management, AML compliance, and

The Master Circular on Operations and Allied Matters of

underwriting decisions cannot be outsourced.

Insurers, issued by the Insurance Regulatory and

Development Authority of India (IRDAI) on June 19, 2024, Reporting: Insurers must regularly report

aims to consolidate various guidelines for the effective and outsourcing activities.

compliant functioning of insurers. This document replaces

4. Grievance Redressal System

earlier guidelines and provides a comprehensive framework

for advertising, opening of business locations, outsourcing Board Approved Policy: Insurers must have a

activities, grievance redressal, usage of trade logos, group board-approved grievance redressal policy.

insurance policies, handling unclaimed amounts, and Technology-Based Solutions: Establish a

policyholder engagement. grievance portal/app for efficient grievance

handling.

Key Sections and Provisions Zero Grievances Goal: Aim to minimize grievances

1. Advertisement Compliance through consumer-friendly processes.

Advertisement Committee: Insurers must have an 5. Usage of Trade Logos

Advertisement Committee and compliance officer Written Agreement: Usage of trade logos of

to oversee advertisement content.

promoting partners must be backed by a written

Prohibited Advertisements: Ads should not agreement specifying terms and consideration.

compare rates, exaggerate benefits, or denigrate

competitors. Ads must disclose risk factors for 6. Group Insurance Policies

linked products and avoid portraying them as Underwriting Policy: Insurers must have a board-

investment options. approved group underwriting policy.

Ratings and Awards: Only ratings or awards from Premium and Benefits: Group master

independent sources can be mentioned. policyholders should not collect amounts higher

than the insurance premium from individual

2. Opening of Places of Business members.

Approval Process: Insurers must submit proposals 7. Unclaimed Amounts of Policyholders

in specified forms for opening new offices or Definition and Treatment: Includes any amount

relocating existing ones. Approvals are valid for one payable to consumers remaining unpaid beyond 12

year.

months. Unclaimed amounts older than 10 years

Foreign Branches: Insurers must follow detailed must be transferred to the Senior Citizens' Welfare

requirements for opening representative or branch Fund (SCWF).

offices outside India.

Disclosure Requirements: Insurers must maintain

searchable databases for unclaimed amounts and

3. Outsourcing of Activities update them regularly.

Principles: Due diligence, written contracts, and

risk management are mandatory.

38 August 2024 The Insurance Times