Page 28 - BANKING FINANCE FEBRUARY 2016 ONLINE

P. 28

PRESS RELEASE

crores in Jun 14 to Rs.1,63,678 crores in Jun 15 (13.50% Annexure

YOY growth).

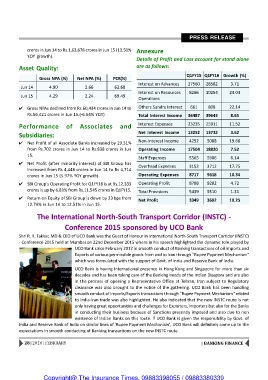

Details of Profit and Loss account for stand alone

Asset Quality: are as follows:

Gross NPA (%) Net NPA (%) PCR(%) Q1FY15 Q1FY16 Growth (%)

4.90 2.66 62.68

Jun 14 4.29 2.24 69.49 Interest on Advances 27560 28582 3.71

Jun 15

Interest on Resources 8266 10254 24.04

Operations

Gross NPAs declined from Rs.60,434 crores in Jun 14 to Others Sundry Interest 661 808 22.14

8.65

Rs.56,421 crores in Jun 15.(-6.64% YOY) Total Interest Income 36487 39643

Performance of Associates and Interest Expenses 23235 25911 11.52

Net Interest Income 13252 13732 3.62

Subsidiaries: Non-Interest Income 4252 5088 19.66

Operating Income 17504 18820 7.52

Net Profit of all Associate Banks increased by 19.31% Staff Expenses 5565 5906 6.14

from Rs.702 crores in Jun 14 to Rs.838 crores in Jun Overhead Expenses 3152 3712 17.75

15. Operating Expenses 8717 9618 10.34

Net Profit (after minority interest) of SBI Group has

increased from Rs 4,448 crores in Jun 14 to Rs 4,714

crores in Jun 15 (5.97% YOY growth).

SBI Group's Operating Profit for Q1FY16 is at Rs.12,333 Operating Profit 8788 9202 4.72

crores is up by 6.83% from Rs.11,545 crores in Q1FY15. Total Provisions 5439 5510 1.31

Net Profit 3349 3692 10.25

Return on Equity of SBI Group is down by 23 bps from

12.74% in Jun 14 to 12.51% in Jun 15.

The International North-South Transport Corridor (INSTC) -

Conference 2015 sponsored by UCO Bank

Shri R. K. Takkar, MD & CEO of UCO Bank was the Guest of Honour in International North-South Transport Corridor (INSTC)

- Conference 2015 held at Mumbai on 22nd December 2015 where in his speech highlighted the dynamic role played by

UCO Bank since February 2012 in smooth conduct of Banking transactions of oil Imports and

Exports of various permissible goods from and to Iran through "Rupee Payment Mechanism"

which was formulated with the support of Govt. of India and Reserve Bank of India.

UCO Bank is having International presence in Hong Kong and Singapore for more than six

decades and has been taking care of the Banking needs of the Indian Diaspora and are also

in the process of opening a Representative Office at Tehran, Iran subject to Regulatory

clearance was also brought to the notice of the gathering. UCO Bank has been handling

smooth conduct of Imports/Exports transactions through "Rupee Payment Mechanism" related

to India-Iran trade was also highlighted. He also indicated that the new INSTC route is not

only having great opportunities and challenges for Exporters, Importers but also for the Banks

in conducting their business because of Sanctions presently imposed and also due to non

existence of Indian Banks on this route. If UCO Bank is given the responsibility by Govt. of

India and Reserve Bank of India on similar lines of 'Rupee Payment Mechanism', UCO Bank will definitely come up to the

expectations in smooth conducting of Banking transactions on the new INSTC route.

28 | 2016 | FEBRUARY | BANKING FINANCE

Copyright@ The Insurance Times. 09883398055 / 09883380339