Page 22 - The Insurance Times February 2025

P. 22

often does not get to know the coverage adequately. It References:

results in huge disappointment when she chooses to claim. 1. Prabakaran, M. (2017). A reflexive rethinking on praxis

She finds many things are either not covered or not paid intervention. In A. K. Giri (Ed.), Pathways of creative re-

adequately. Despite the shared interest and inclusive ap- search: Towards a festival of dialogues (Vol. 2, pp. 313-

proach, the business tends to lapse into unethical practices 332). Primus.

due to non-transparent and somewhat casual approaches 2. Prabakaran, M. (2025) A Practical Framework for Invest-

to business. The business needs to refine or rediscover its ing in Ethical Capital: Economic Insights for Business

decision to escape the ambivalence. 3. Cynthia Schoeman (2019) Giving due recognition to

ethical capital - Ltd- https://www.ethicsmonitor.co.za/

Therefore, ethical capital is a conscious decision a business Ethical-capital.aspx

needs to take to emerge as a winner in the marketplace. 4 Addressing Obstacles to Life Insurance Demand- The

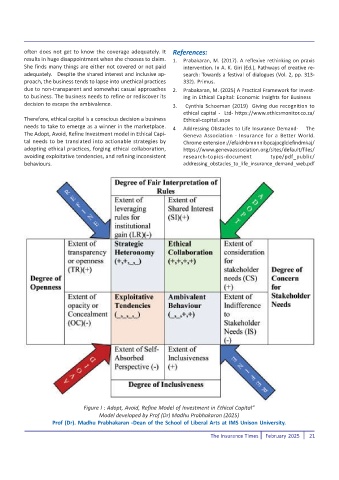

The Adopt, Avoid, Refine Investment model in Ethical Capi- Geneva Association - Insurance for a Better World.

tal needs to be translated into actionable strategies by Chrome extension://efaidnbmnnnibpcajpcglclefindmkaj/

adopting ethical practices, forging ethical collaboration, https://www.genevaassociation.org/sites/default/files/

avoiding exploitative tendencies, and refining inconsistent research-topics-document type/pdf_public/

behaviours. addressing_obstacles_to_life_insurance_demand_web.pdf

Figure I : Adopt, Avoid, Refine Model of Investment in Ethical Capital"

Model developed by Prof (Dr) Madhu Prabhakaran (2025)

Prof (Dr). Madhu Prabhakaran -Dean of the School of Liberal Arts at IMS Unison University.

The Insurance Times February 2025 21