Page 41 - The Insurance Times February 2025

P. 41

the legitimacy of life insurance claims and highlighted vul- a believable narrative. The use of planted evidence added

nerabilities in the system. an element of sophistication to the scam.

Recovery Media Frenzy:

The bizarre and dramatic nature of the case captured pub-

The insurers successfully prevented the payout and recov-

ered some of the investigation costs through the seizure of lic imagination and became a sensational story. It drew at-

tention not only to the perpetrators but also to the larger

assets. However, the financial and reputational damages

were significant. The case prompted insurers to review and issue of insurance fraud.

tighten their protocols for investigating accidental death Learning Opportunity:

claims, particularly those involving unique or unverifiable This case underscores the importance of due diligence and

circumstances.

thorough investigation by insurers. It also serves as a re-

minder of the lengths individuals may go to exploit perceived

Why This Case is Interesting loopholes in the system. The discovery of the fraud through

Creative Execution: surveillance and financial tracking highlights the critical role

The choice of a shark attack, a rare but plausible event in of modern investigative techniques in combating such

Australia, demonstrated the couple's creativity in crafting scams.

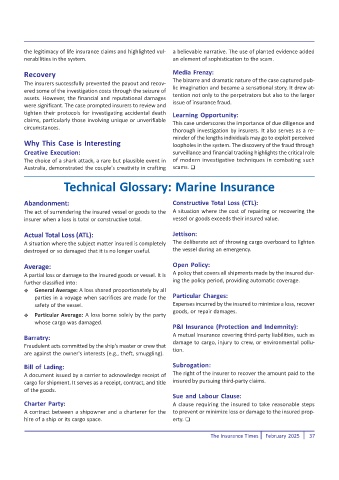

Technical Glossary: Marine Insurance

Abandonment: Constructive Total Loss (CTL):

The act of surrendering the insured vessel or goods to the A situation where the cost of repairing or recovering the

insurer when a loss is total or constructive total. vessel or goods exceeds their insured value.

Actual Total Loss (ATL): Jettison:

A situation where the subject matter insured is completely The deliberate act of throwing cargo overboard to lighten

destroyed or so damaged that it is no longer useful. the vessel during an emergency.

Average: Open Policy:

A partial loss or damage to the insured goods or vessel. It is A policy that covers all shipments made by the insured dur-

further classified into: ing the policy period, providing automatic coverage.

General Average: A loss shared proportionately by all

parties in a voyage when sacrifices are made for the Particular Charges:

safety of the vessel. Expenses incurred by the insured to minimize a loss, recover

goods, or repair damages.

Particular Average: A loss borne solely by the party

whose cargo was damaged.

P&I Insurance (Protection and Indemnity):

Barratry: A mutual insurance covering third-party liabilities, such as

damage to cargo, injury to crew, or environmental pollu-

Fraudulent acts committed by the ship's master or crew that

are against the owner's interests (e.g., theft, smuggling). tion.

Bill of Lading: Subrogation:

A document issued by a carrier to acknowledge receipt of The right of the insurer to recover the amount paid to the

cargo for shipment. It serves as a receipt, contract, and title insured by pursuing third-party claims.

of the goods.

Sue and Labour Clause:

Charter Party: A clause requiring the insured to take reasonable steps

A contract between a shipowner and a charterer for the to prevent or minimize loss or damage to the insured prop-

hire of a ship or its cargo space. erty.

The Insurance Times February 2025 37