Page 30 - The Insurance Times July 2020

P. 30

perils, it would appear unlikely that this being bought by customers. Buying new policies where insurers need to carry

virus is a covered event, in the existing out medical tests are taking time and have slowdown. No more new policy

policy coverages. It's possible that the issuance for NRIs or those with recent travel history. So, overall, insurance industry

virus could be more material for the has been hit from many directions.

nonlife sector than life because of

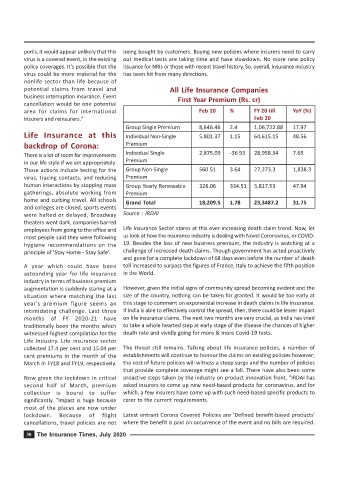

potential claims from travel and All Life Insurance Companies

business interruption insurance. Event First Year Premium (Rs. cr)

cancellation would be one potential

area for claims for international Feb 20 % FY 20 till YoY (%)

insurers and reinsurers." Feb 20

Group Single Premium 8,646.46 2.4 1,06,722.88 17.97

Life Insurance at this Individual Non-Single 5,801.37 1.15 64,615.15 48.56

backdrop of Corona: Premium

Individual Single 2,875.09 -36.93 28,958.34 7.65

There is a lot of room for improvements

in our life style if we act appropriately. Premium

Those actions include testing for the Group Non-Single 560.51 3.64 27,373.3 1,838.3

virus, tracing contacts, and reducing Premium

human interactions by stopping mass Group Yearly Renewable 326.06 334.51 5,817.53 47.94

gatherings, absolute working from Premium

home and curbing travel. All schools Grand Total 18,209.5 1.78 23,3487.2 31.75

and colleges are closed, sports events

were halted or delayed, Broadway Source : IRDAI

theaters went dark, companies barred

employees from going to the office and Life Insurance Sector stares at this ever-increasing death claim trend. Now, let

most people said they were following us look at how the insurance industry is dealing with Novel Coronavirus, or COVID-

hygiene recommendations on the 19. Besides the loss of new business premium, the industry is watching at a

principle of 'Stay Home - Stay Safe'. challenge of increased death claims. Though government has acted proactively

and gone for a complete lockdown of 68 days even before the number of death

A year which could have been toll increased to surpass the figures of France, Italy to achieve the fifth position

astounding year for life insurance in the World.

industry in terms of business premium

augmentation is suddenly staring at a However, given the initial signs of community spread becoming evident and the

situation where matching the last size of the country, nothing can be taken for granted. It would be too early at

year's premium figure seems an this stage to comment on exponential increase in death claims in life insurance.

intimidating challenge. Last three If India is able to effectively control the spread, then, there could be lesser impact

months of FY 2020-21 have on life insurance claims. The next two months are very crucial, as India has tried

traditionally been the months which to take a whole hearted step at early stage of the disease the chances of higher

witnessed highest compilation for the death rate and vividly going for more & more Covid-19 tests.

Life Industry. Life insurance sector

collected 17.4 per cent and 15.04 per The threat still remains. Talking about life insurance policies, a number of

cent premiums in the month of the establishments will continue to honour the claims on existing policies however;

March in FY18 and FY19, respectively. the cost of future policies will witness a steep surge and the number of policies

that provide complete coverage might see a fall. There have also been some

Now given the lockdown in critical proactive steps taken by the industry on product innovation front. "IRDAI has

second half of March, premium asked insurers to come up new need-based products for coronavirus, and for

collection is bound to suffer which, a few insurers have come up with such need-based specific products to

significantly. "Impact is huge because cater to the current requirements.

most of the places are now under

lockdown. Because of flight Latest entrant Corona Covered Policies are 'Defined benefit-based products'

cancellations, travel policies are not where the benefit is paid on occurrence of the event and no bills are required.

30 The Insurance Times, July 2020