Page 53 - Banking Finance October 2015

P. 53

RBI CIRCULAR

3. AD Category-I banks may bring the contents of this fourth Saturdays but would operate for full day on working

Circular to the notice of their constituents concerned. Saturdays. Processing of future value dated transactions

with value date falling on second and fourth Saturdays will

4. The Directions contained in this circular have been issued not be undertaken under RTGS.

under section 10(4) and 11(1) of the Foreign Exchange

Management Act (FEMA), 1999 (42 of 1999) and are 3. The RTGS time window with effect from September 1,

without prejudice to permissions / approvals, if any, required 2015 will be as under:

under any other law.

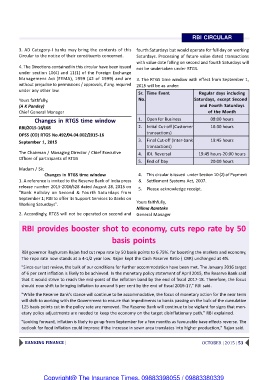

Sr. Time Event Regular days including

Yours faithfully, No. Saturdays, except Second

(A K Pandey)

Chief General Manager and Fourth Saturdays

of the Month

Changes in RTGS time window

1. Open for Business 08:00 hours

RBI/2015-16/168

DPSS (CO) RTGS No.492/04.04.002/2015-16 2. Initial Cut-off (Customer 16:30 hours

September 1, 2015 transactions)

The Chairman / Managing Director / Chief Executive 3. Final Cut-off (Inter-bank 19:45 hours

Officer of participants of RTGS transactions)

Madam / Sir, 4. IDL Reversal 19:45 hours-20:00 hours

Changes in RTGS time window

5. End of Day 20:00 hours

1. A reference is invited to the Reserve Bank of India press

release number 2015-2016/528 dated August 28, 2015 on 4. This circular is issued under Section 10 (2) of Payment

"Bank Holiday on Second & Fourth Saturdays from & Settlement Systems Act, 2007.

September 1; RBI to offer its Support Services to Banks on

Working Saturdays". 5. Please acknowledge receipt.

2. Accordingly, RTGS will not be operated on second and Yours faithfully,

Nilima Ramteke

General Manager

RBI provides booster shot to economy, cuts repo rate by 50

basis points

RBI governor Raghuram Rajan had cut repo rate by 50 basis points to 6.75%. for boosting the markets and economy,

The repo rate now stands at a 4-1/2 year low. Rajan kept the Cash Reserve Ratio ( CRR) unchanged at 4%.

"Since our last review, the bulk of our conditions for further accommodation have been met. The January 2016 target

of 6 per cent inflation is likely to be achieved. In the monetary policy statement of April 2015, the Reserve Bank said

that it would strive to reach the mid-point of the inflation band by the end of fiscal 2017-18. Therefore, the focus

should now shift to bringing inflation to around 5 per cent by the end of fiscal 2016-17," RBI said.

"While the Reserve Bank's stance will continue to be accommodative, the focus of monetary action for the near term

will shift to working with the Government to ensure that impediments to banks passing on the bulk of the cumulative

125 basis points cut in the policy rate are removed. The Reserve Bank will continue to be vigilant for signs that mon-

etary policy adjustments are needed to keep the economy on the target disinflationary path," RBI explained.

"Looking forward, inflation is likely to go up from September for a few months as favourable base effects reverse. The

outlook for food inflation could improve if the increase in sown area translates into higher production," Rajan said.

BANKING FINANCE | OCTOBER | 2015 | 53

Copyright@ The Insurance Times. 09883398055 / 09883380339