Page 29 - The Insurance Times December 2024

P. 29

tient care, including maternity and critical illnesses like choosing a health insurance plan. Ensure the ability to switch

cancer as per your health care needs. plans or insurers without losing benefits. This flexibility al-

Network: Ensure a wide network of hospitals with cash- lows you to upgrade your coverage as your health needs

less facilities for hassle-free claims. evolve. Consider top-up plans to enhance your existing cov-

erage without significantly increasing your premium. These

Pre-existing Conditions: Check waiting periods and cov- plans act as additional coverage in case your base plan's sum

erage details for existing health issues. insured gets exhausted.

No-Claim Bonus: Plans offering this can enhance your

coverage by increasing your sum insured over time Look for plans that offer regular health check-ups to catch

potential health issues early, preventing more severe health

Daycare and Domiciliary Treatment: Coverage for

treatments not requiring full hospitalization, and medi- problems in the future. Plans that include wellness programs

cal care at home. and incentives for maintaining good health can add value

and promote a healthier lifestyle.

Ambulance and Post-Hospitalization: Look for cover-

age of ambulance charges and expenses before and Evaluating and Comparing Plans

after hospital stays.

When it comes to choosing the right health insurance, tak-

Wellness Programs: Plans that reward healthy habits ing the time to evaluate and compare plans is essential.

and incentivize healthy behaviors. Start by doing some research on the options available. Use

online tools, dive into the policy documents, and look at the

Financial Considerations benefits and costs of each plan. Remember, the cheapest

When it comes to choosing a health insurance plan, finan- plan isn't always the best one-make sure it meets your spe-

cial considerations are key. It's all about finding the right cific needs.

balance between what you pay in premiums and the cover-

age you get. While, higher premiums may mean better Talking to insurance advisors or experts can be really help-

coverage, but you want to make sure you're getting your ful. They can break down the details of different plans and

money's worth. offer insights that you might not have considered. Don't

forget to check out what current policyholders are saying.

Real-world feedback can give you a better idea of the

Don't forget about out-of-pocket expenses! High deductibles

insurer's service quality and reliability. Look for reviews on

or copayments might lower your premiums, but they can

also mean more money out of your pocket when you need their claim settlement process, customer service, and over-

to make a claim. Look for an insurer with a good track all satisfaction. This way, you'll have a clearer picture and

record for settling claims quickly and fairly. Another thing can choose a plan with confidence.

to consider is a no-claim bonus. If you stay healthy and don't In the end, choosing the right health insurance plan means

make any claims, some plans may reward you by increasing thinking about your current and future health needs, under-

your coverage by increasing your sum insured. Alternatively, standing the key features, considering the costs, and looking

as a reward for your healthy habits your premium maybe

at how flexible and beneficial each plan is. Take your time

discounted over time. This can really add up and save you

and be proactive about it. The right plan will not only protect

money in the long run.

you financially but also give you peace of mind as you go

through different stages of life and face health challenges.

Flexibility and Additional Benefits Make sure your health insurance grows with you, giving you

Flexibility and additional benefits are also important when the support and coverage you need every step of the way.

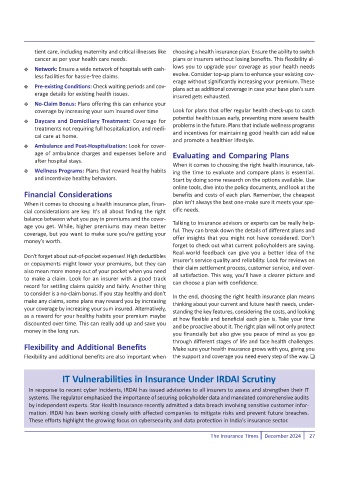

IT Vulnerabilities in Insurance Under IRDAI Scrutiny

In response to recent cyber incidents, IRDAI has issued advisories to all insurers to assess and strengthen their IT

systems. The regulator emphasized the importance of securing policyholder data and mandated comprehensive audits

by independent experts. Star Health Insurance recently admitted a data breach involving sensitive customer infor-

mation. IRDAI has been working closely with affected companies to mitigate risks and prevent future breaches.

These efforts highlight the growing focus on cybersecurity and data protection in India's insurance sector.

The Insurance Times December 2024 27