Page 26 - Insurance Times May 2023

P. 26

a widespread charging infrastructure is required. In this (b) Long Term Premium Rates:

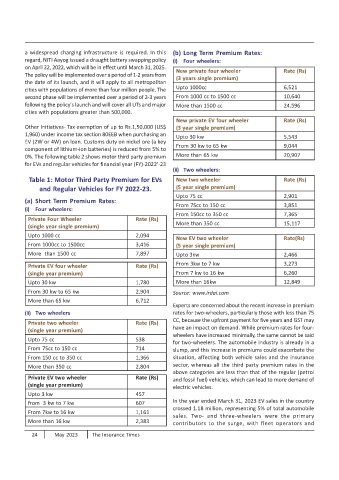

regard, NITI Aayog issued a draught battery swapping policy (i) Four wheelers:

on April 22, 2022, which will be in effect until March 31, 2025.

New private four wheeler Rate (Rs)

The policy will be implemented over a period of 1-2 years from

(3 years single premium)

the date of its launch, and it will apply to all metropolitan

Upto 1000cc 6,521

cities with populations of more than four million people. The

second phase will be implemented over a period of 2-3 years From 1000 cc to 1500 cc 10,640

following the policy's launch and will cover all UTs and major More than 1500 cc 24,596

cities with populations greater than 500,000.

New private EV four wheeler Rate (Rs)

Other Initiatives- Tax exemption of up to Rs.1,50,000 (US$ (3 year single premium)

1,960) under income tax section 80EEB when purchasing an

Upto 30 kw 5,543

EV (2W or 4W) on loan. Customs duty on nickel ore (a key

From 30 kw to 65 kw 9,044

component of lithium-ion batteries) is reduced from 5% to

More than 65 kw 20,907

0%. The following table 2 shows motor third party premium

for EVs and regular vehicles for financial year (FY)-2022'-23

(ii) Two wheelers:

Table 1: Motor Third Party Premium for EVs New two wheeler Rate (Rs)

(5 year single premium)

and Regular Vehicles for FY 2022-23.

Upto 75 cc 2,901

(a) Short Term Premium Rates:

From 75cc to 150 cc 3,851

(i) Four wheelers:

From 150cc to 350 cc 7,365

Private Four Wheeler Rate (Rs)

More than 350 cc 15,117

(single year single premium)

Upto 1000 cc 2,094

New EV two wheeler Rate(Rs)

From 1000cc to 1500cc 3,416 (5 year single premium)

More than 1500 cc 7,897 Upto 3kw 2,466

From 3kw to 7 kw 3,273

Private EV four wheeler Rate (Rs)

(single year premium) From 7 kw to 16 kw 6,260

Upto 30 kw 1,780 More than 16kw 12,849

From 30 kw to 65 kw 2,904 Source: www.irdai.com

More than 65 kw 6,712

Experts are concerned about the recent increase in premium

(ii) Two wheelers rates for two-wheelers, particularly those with less than 75

CC, because the upfront payment for five years and GST may

Private two wheeler Rate (Rs)

have an impact on demand. While premium rates for four-

(single year premium)

wheelers have increased minimally, the same cannot be said

Upto 75 cc 538

for two-wheelers. The automobile industry is already in a

From 75cc to 150 cc 714

slump, and this increase in premiums could exacerbate the

From 150 cc to 350 cc 1,366 situation, affecting both vehicle sales and the insurance

sector, whereas all the third party premium rates in the

More than 350 cc 2,804

above categories are less than that of the regular (petrol

Private EV two wheeler Rate (Rs)

and fossil fuel) vehicles, which can lead to more demand of

(single year premium)

electric vehicles.

Upto 3 kw 457

In the year ended March 31, 2023 EV sales in the country

from 3 kw to 7 kw 607

crossed 1.18 million, representing 5% of total automobile

From 7kw to 16 kw 1,161

sales. Two- and three-wheelers were the primary

More than 16 kw 2,383

contributors to the surge, with fleet operators and

24 May 2023 The Insurance Times