Page 127 - Ebook health insurance IC27

P. 127

Sashi Publications

Group insurance schemes

Group insurance is the most common form of health insurance available globally.

Under group insurance instead of granting covers to individual persons, a single

health insurance policy is given to large number of persons which helps in saving of

premium cost and administrative expenses.

If the number of group is larger, the bargaining power of the group increases and as

a result they can get better rates and terms.

Important factors for issuing group insurance policy

a. Group must not be formed for taking insurance

b. group must have minimum number of members

c. there must be a group organiser liasioning on behalf of group

d. group insurance policy can be issued to groups like employer-employee groups and

affinity group (member of credit card company)

e. Premium payment may be contributory or non-contributory.

f. In contributory both employer and employee will share the premium and a non-

contributory the employer or an affinity group pays the premium

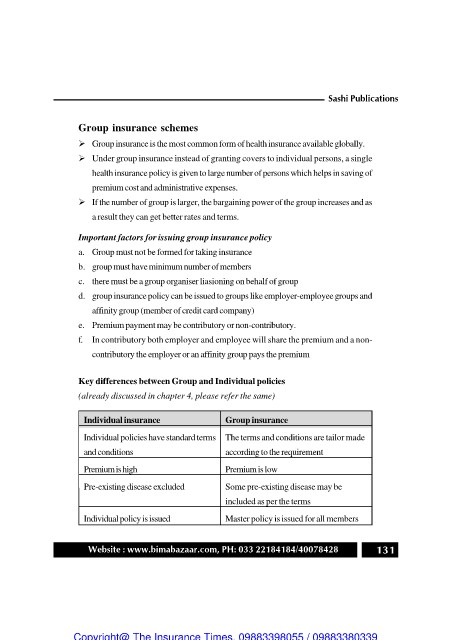

Key differences between Group and Individual policies

(already discussed in chapter 4, please refer the same)

Individual insurance Group insurance

Individual policies have standard terms The terms and conditions are tailor made

and conditions according to the requirement

Premium is high Premium is low

Pre-existing disease excluded Some pre-existing disease may be

included as per the terms

Individual policy is issued Master policy is issued for all members

Website : www.bimabazaar.com, PH: 033 22184184/40078428 131