Page 128 - Ebook health insurance IC27

P. 128

The Insurance Times

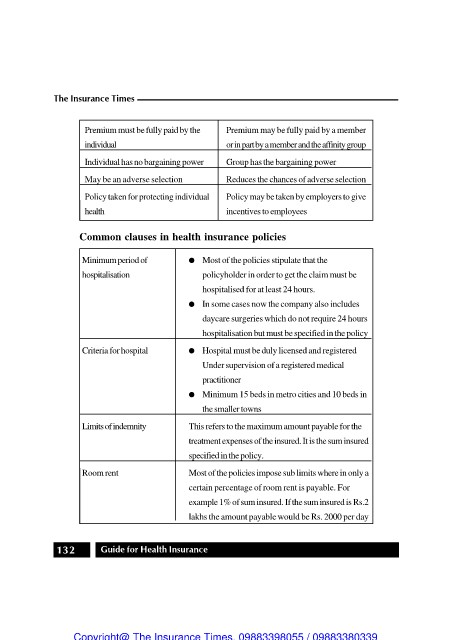

Premium must be fully paid by the Premium may be fully paid by a member

individual orin partby amemberandtheaffinity group

Individual has no bargaining power Group has the bargaining power

May be an adverse selection Reduces the chances of adverse selection

Policy taken for protecting individual Policy may be taken by employers to give

health incentives to employees

Common clauses in health insurance policies

Minimum period of l Most of the policies stipulate that the

hospitalisation policyholder in order to get the claim must be

hospitalised for at least 24 hours.

Criteria for hospital

l In some cases now the company also includes

Limits ofindemnity daycare surgeries which do not require 24 hours

Room rent hospitalisation but must be specified in the policy

l Hospital must be duly licensed and registered

Under supervision of a registered medical

practitioner

l Minimum 15 beds in metro cities and 10 beds in

the smaller towns

This refers to the maximum amount payable for the

treatment expenses of the insured. It is the sum insured

specified in the policy.

Most of the policies impose sub limits where in only a

certain percentage of room rent is payable. For

example 1% of sum insured. If the sum insured is Rs.2

lakhs the amount payable would be Rs. 2000 per day

132 Guide for Health Insurance