Page 315 - Ebook health insurance IC27

P. 315

Sashi Publications

These conditions are not under thescope of medical insurance. However, initial diagnostic

investigations until the diagnosis is confirmed, are usually covered.

Excess

Excess (or deductible) is defined as the first amount, payable by the insured member

towards the cost of each claim (often outpatient). If the cost of treatment is less than the

excess amount, then the insured person will be liable to pay all the expenses.

The excess may be expressed as:

n a flat amount (for example Rs. 50 or Rs. 100); or

n as a percentage of total treatment cost

Further, the excess may be imposed on aggregate:

n per service or episode of service;

n per life time;

n per calendar year; or

n perfamily

Coinsurance

This is the amount an insured person is required to pay for the cost of services after he

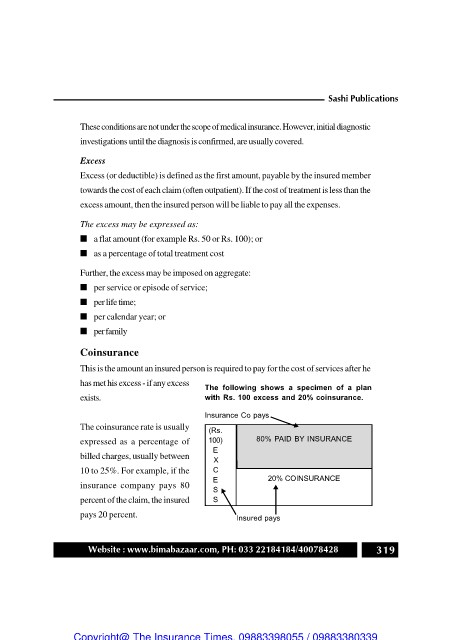

has met his excess - if any excess The following shows a specimen of a plan

exists. with Rs. 100 excess and 20% coinsurance.

The coinsurance rate is usually Insurance Co pays

expressed as a percentage of

billed charges, usually between (Rs.

10 to 25%. For example, if the 100) 80% PAID BY INSURANCE

insurance company pays 80

percent of the claim, the insured E

pays 20 percent. X

C

E 20% COINSURANCE

S

S

Insured pays

Website : www.bimabazaar.com, PH: 033 22184184/40078428 319