Page 79 - Ebook health insurance IC27

P. 79

Sashi Publications

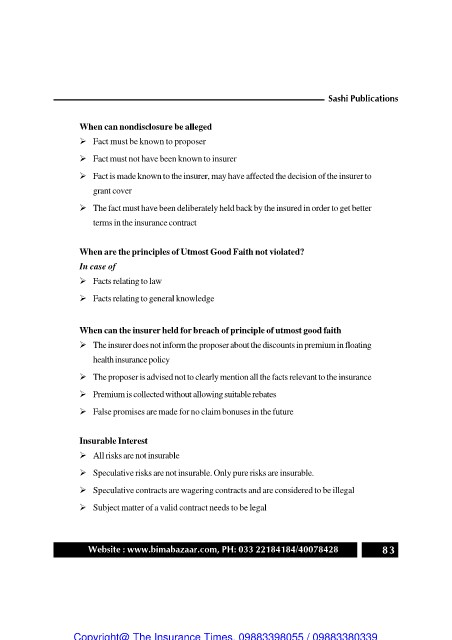

When can nondisclosure be alleged

Fact must be known to proposer

Fact must not have been known to insurer

Fact is made known to the insurer, may have affected the decision of the insurer to

grant cover

The fact must have been deliberately held back by the insured in order to get better

terms in the insurance contract

When are the principles of Utmost Good Faith not violated?

In case of

Facts relating to law

Facts relating to general knowledge

When can the insurer held for breach of principle of utmost good faith

The insurer does not inform the proposer about the discounts in premium in floating

health insurance policy

The proposer is advised not to clearly mention all the facts relevant to the insurance

Premium is collected without allowing suitable rebates

False promises are made for no claim bonuses in the future

Insurable Interest

All risks are not insurable

Speculative risks are not insurable. Only pure risks are insurable.

Speculative contracts are wagering contracts and are considered to be illegal

Subject matter of a valid contract needs to be legal

Website : www.bimabazaar.com, PH: 033 22184184/40078428 83