Page 34 - Banking Finance February 2018

P. 34

ARTICLE

Similarly, small finance banks, whose expertise is community shall be Rs. 100 crore and the bank's outside liabilities

banking, will scale up their model with the advantage of should not exceed 33.33 times its net worth (paid-up

low cost funds . Their emergence can be seen as an capital and reserves). Thus the payment bank is

opportunity for bigger banks to penetrate more deeply into permitted to go up to deposit business of Rs. 3333

the rural market since payments banks are allowed to crores with 100 crores capital. Out of the total

function as business correspondents (BC) too. commercial banks deposit of Rs. 85.33 trillion as of

March 2015, Current deposit and saving deposit

For instance, Reliance Industries (RIL) entered into a

partnership with State Bank of India (SBI), for a constitutes about 10 % and 26 % respectively . Of the

payments bank licence. RIL and SBI, in a first of its kind total deposits , deposits from Household accounts for

59.7 % (Graph-1) .

public-private partnership, have joined on a mission to

make India's financial services digitally smart. SBI's vast

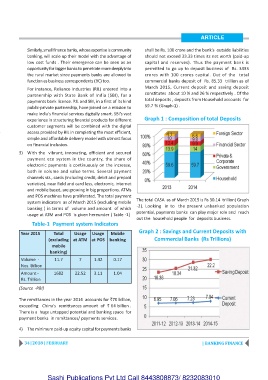

experience in structuring financial products for different Graph 1 : Composition of total Deposits

customer segments will be combined with the digital

access provided by RIL in completing the most efficient,

simple and affordable delivery model with utmost focus

on financial inclusion.

3) With the vibrant, innovating, efficient and secured

payment eco system in the country, the share of

electronic payments is continuously on the increase,

both in volume and value terms. Several payment

channels viz., cards (including credit, debit and prepaid

varieties), near field and card less, electronic, internet

and mobile based, are growing in big proportions. ATMs

and POS machines have proliferated. The total payment

system indicators as of March 2015 (excluding mobile The total CASA as of March 2015 is Rs 30.14 trillion( Graph

-2). Looking in to the present unbanked population

banking ) in terms of volume and amount of which

potential, payments banks can play major role and reach

usage at ATM and POS is given hereunder ( Table -1)

out the household people for deposits business.

Table-1 Payment system Indicators

Graph 2 : Savings and Current Deposits with

Year 2015 Total Usage Usage Mobile

(excluding at ATM at POS banking Commercial Banks (Rs Trillions)

mobile

banking)

Volume - 11.7 7 1.42 0.17

Nos. Billion

Amount - 1682 22.52 3.11 1.04

Rs. Trillion

(Source -RBI)

The remittances in the year 2014 accounts for $70 billion,

exceeding China's remittances amount of $ 64 billion .

There is a huge untapped potential and banking space for

payment banks in remittances/ payments services.

4) The minimum paid-up equity capital for payments banks

34 | 2018 | FEBRUARY | BANKING FINANCE

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010