Page 25 - Insurance Times April 2020

P. 25

reviewed autonomously instant pay-outs can easily be information if it means saving money on their insurance

achieved and only in a matter of hours the customer can policies - and IoT can automate much of that data sharing.

have his claim amount credited to his Bank account. Insurers can use data from IoT devices such as the various

components of smart homes and wearable technologies to

Of late some insurers have started usingunmanned aerial rationalize premium rates, mitigate risk, and even prevent

vehicle (UAV)commonly known as a drones for claims losses.

assessment of damaged properties.By using a drone, the

time spent on gathering the relevant informationcan be IoT will bolster other insurance technology with first-hand

drastically reduced and the assessor does not even have to data, improving the accuracy of risk assessment and giving

be on-site, as a drone pilot can be sent in his place. insureds more power to directly impact their policy pricing.

3. IoT (Internet of Things) 4. Telematics

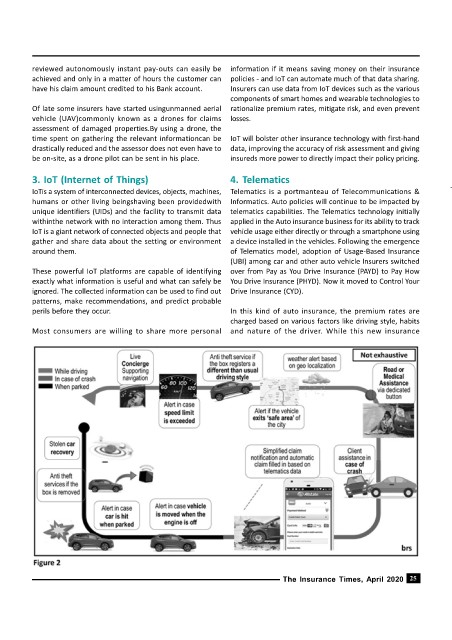

IoTis a system of interconnected devices, objects, machines, Telematics is a portmanteau of Telecommunications &

humans or other living beingshaving been providedwith Informatics. Auto policies will continue to be impacted by

unique identifiers (UIDs) and the facility to transmit data telematics capabilities. The Telematics technology initially

withinthe network with no interaction among them. Thus applied in the Auto insurance business for its ability to track

IoT is a giant network of connected objects and people that vehicle usage either directly or through a smartphone using

gather and share data about the setting or environment a device installed in the vehicles. Following the emergence

around them. of Telematics model, adoption of Usage-Based Insurance

(UBI) among car and other auto vehicle Insurers switched

These powerful IoT platforms are capable of identifying over from Pay as You Drive Insurance (PAYD) to Pay How

exactly what information is useful and what can safely be You Drive Insurance (PHYD). Now it moved to Control Your

ignored. The collected information can be used to find out Drive Insurance (CYD).

patterns, make recommendations, and predict probable

perils before they occur. In this kind of auto insurance, the premium rates are

charged based on various factors like driving style, habits

Most consumers are willing to share more personal and nature of the driver. While this new insurance

The Insurance Times, April 2020 25