Page 17 - Food Outlook

P. 17

WHEAT

PRICES

International prices have decreased but still above last year

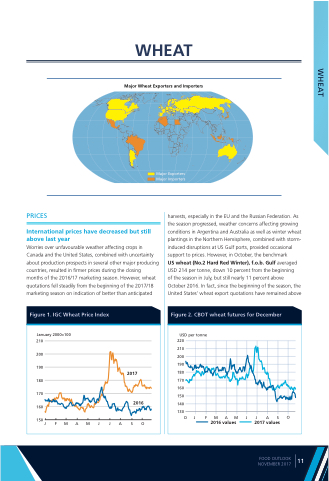

Worries over unfavourable weather affecting crops in Canada and the United States, combined with uncertainty about production prospects in several other major producing countries, resulted in firmer prices during the closing months of the 2016/17 marketing season. However, wheat quotations fell steadily from the beginning of the 2017/18 marketing season on indication of better than anticipated

harvests, especially in the EU and the Russian Federation. As the season progressed, weather concerns affecting growing conditions in Argentina and Australia as well as winter wheat plantings in the Northern Hemisphere, combined with storm- induced disruptions at US Gulf ports, provided occasional support to prices. However, in October, the benchmark

US wheat (No.2 Hard Red Winter), f.o.b. Gulf averaged USD 214 per tonne, down 10 percent from the beginning

of the season in July, but still nearly 11 percent above October 2016. In fact, since the beginning of the season, the United States’ wheat export quotations have remained above

Figure 1. IGC Wheat Price Index

January 2000=100

Figure 2. CBOT wheat futures for December

USD per tonne

210

200

190

180

170

160

150

2017

2016

JFMAMJJASO

220

210

200

190

180

170

160

150

140

130

WHEAT

Major Wheat Exporters and Importers

Major Exporters Major Importers

DJFMAMJJASO

2016 values

2017 values

FOOD OUTLOOK NOVEMBER 2017

11