Page 87 - Food Outlook

P. 87

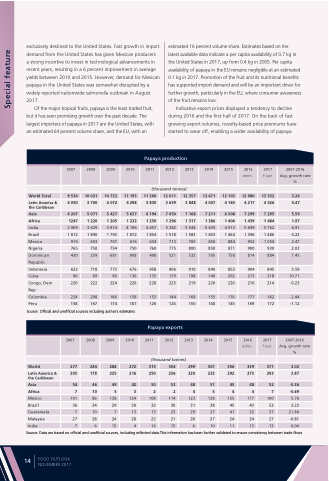

exclusively destined to the United States. Fast growth in import demand from the United States has given Mexican producers

a strong incentive to invest in technological advancements in recent years, resulting in a 6 percent improvement in average yields between 2010 and 2015. However, demand for Mexican papaya in the United States was somewhat disrupted by a widely reported nationwide salmonella outbreak in August 2017.

Of the major tropical fruits, papaya is the least traded fruit, but it has seen promising growth over the past decade. The largest importers of papaya in 2017 are the United States, with an estimated 64 percent volume share, and the EU, with an

estimated 16 percent volume share. Estimates based on the

latest available data indicate a per capita availability of 0.7 kg in the United States in 2017, up from 0.4 kg in 2005. Per capita availability of papaya in the EU remains negligible at an estimated 0.1 kg in 2017. Promotion of the fruit and its nutritional benefits has supported import demand and will be an important driver for further growth, particularly in the EU, where consumer awareness of the fruit remains low.

Indicative export prices displayed a tendency to decline during 2016 and the first half of 2017. On the back of fast growing export volumes, novelty-based price premiums have started to wear off, enabling a wider availability of papaya.

Special feature

2007

9 534 4 050

4 207 1247

2008

10 021 3 700

5 071 1 220

2009

10 732 4 072

5 427 1 205

2010

11 193 4 298

5 637 1 232

Papaya production

2011 2012 2013

(thousand tonnes)

2014

12 671 4 047

7 211 1 386

2015

12 103 4 160

6 508 1 406

2016 estim.

12 980 4 217

7 299 1 439

2017

f’cast

13 332 4 526

7 295 1 484

2007-2016 Avg. growth rate %

3.26 0.47

5.59 1.97 6.91

-3.22 2.47 2.03 7.45

3.59 10.71 -0.23

-2.44 -1.12

2007-2016 Avg. growth rate %

3.02 3.87

-0.36

-5.69

World Total

Latin America & the Caribbean

Asia

Africa

India

Brazil Mexico Nigeria Dominican Republic Indonesia Cuba Congo, Dem Rep Colombia Peru

11 300 3 830

6 194 1 250

12 011 3 639

7 050 1 296

12 357 3 848

7 168 1 317

2 1

909

812

919

765

430

622 90 220

224

158

3 1

629

890

653

750

259

718 89 222

208

167

3 1

914

793

707

754

681

773 96 224

186

174

4 1

196

872

616

750

908

676 136 226

158

187

4 1

457

854

634

760

498

958 135 228

153 126

5 1

382

518

713

775

521

906 179 225

144 124

5 1

544

583

765

800

532

910 198 219

168 150

5 1

639

603

836

850

705

840 140 220

155 148

4 1

913

464

884

871

758

852 202 220

176 145

5 1

699

396

952

900

814

904 213 216

177 169

5 1 1

762

486

054

930

884

845 218 214

182 172

Source: Official and unofficial sources including author’s estimates

2007

World 277

2008 2009

244 288 178 225

46 49 10 5 86 138 34 29 10 7 28 24

6 15

2010

272 216

42 3 124 30 13 28 4

Papaya exports

2011 2012

2013

2014

2015

356 292

2016 estim.

339 275

2017

f’cast

371 293

(thousand tonnes)

205

Asia

Africa

Mexico 101

315 304 299 301 250 236 220 232

50 53 48 51 2 2 4 5 108 114 123 138 32 30 31 38 13 25 29 27 22 21 28 27 16 15 6 10

Latin America & the Caribbean

54 7

45 48 52 4 4 7

Brazil Guatemala Malaysia India

36 7 27 7

155 177 190 5.76 45 43 52 3.22 41 32 37 21.80 24 24 27 -0.81 11 13 13 6.04

Source: Data are based on official and unofficial sources, including reflected data.This information has been further validated to ensure consistency between trade flows

FOOD OUTLOOK NOVEMBER 2017

14