Page 4 - A Level Business Studies - Financial Analysis Tasks

P. 4

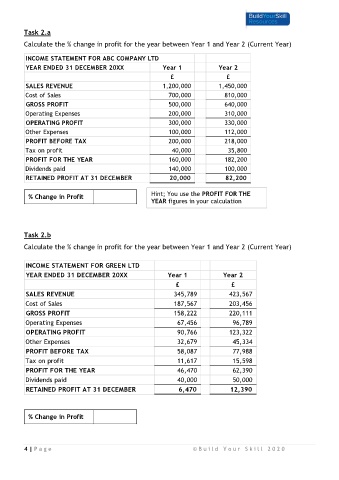

Task 2.a

Calculate the % change in profit for the year between Year 1 and Year 2 (Current Year)

INCOME STATEMENT FOR ABC COMPANY LTD

YEAR ENDED 31 DECEMBER 20XX Year 1 Year 2

£ £

SALES REVENUE 1,200,000 1,450,000

Cost of Sales 700,000 810,000

GROSS PROFIT 500,000 640,000

Operating Expenses 200,000 310,000

OPERATING PROFIT 300,000 330,000

Other Expenses 100,000 112,000

PROFIT BEFORE TAX 200,000 218,000

Tax on profit 40,000 35,800

PROFIT FOR THE YEAR 160,000 182,200

Dividends paid 140,000 100,000

RETAINED PROFIT AT 31 DECEMBER 20,000 82,200

% Change in Profit Hint; You use the PROFIT FOR THE

YEAR figures in your calculation

Task 2.b

Calculate the % change in profit for the year between Year 1 and Year 2 (Current Year)

INCOME STATEMENT FOR GREEN LTD

YEAR ENDED 31 DECEMBER 20XX Year 1 Year 2

£ £

SALES REVENUE 345,789 423,567

Cost of Sales 187,567 203,456

GROSS PROFIT 158,222 220,111

Operating Expenses 67,456 96,789

OPERATING PROFIT 90,766 123,322

Other Expenses 32,679 45,334

PROFIT BEFORE TAX 58,087 77,988

Tax on profit 11,617 15,598

PROFIT FOR THE YEAR 46,470 62,390

Dividends paid 40,000 50,000

RETAINED PROFIT AT 31 DECEMBER 6,470 12,390

% Change in Profit

4 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0