Page 6 - A Level Business Studies - Financial Analysis Tasks

P. 6

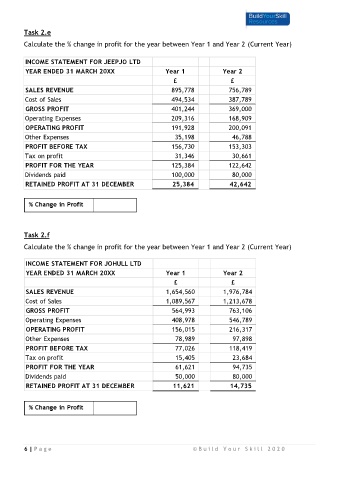

Task 2.e

Calculate the % change in profit for the year between Year 1 and Year 2 (Current Year)

INCOME STATEMENT FOR JEEPJO LTD

YEAR ENDED 31 MARCH 20XX Year 1 Year 2

£ £

SALES REVENUE 895,778 756,789

Cost of Sales 494,534 387,789

GROSS PROFIT 401,244 369,000

Operating Expenses 209,316 168,909

OPERATING PROFIT 191,928 200,091

Other Expenses 35,198 46,788

PROFIT BEFORE TAX 156,730 153,303

Tax on profit 31,346 30,661

PROFIT FOR THE YEAR 125,384 122,642

Dividends paid 100,000 80,000

RETAINED PROFIT AT 31 DECEMBER 25,384 42,642

Task 2.f

Calculate the % change in profit for the year between Year 1 and Year 2 (Current Year)

INCOME STATEMENT FOR JOHULL LTD

YEAR ENDED 31 MARCH 20XX Year 1 Year 2

£ £

SALES REVENUE 1,654,560 1,976,784

Cost of Sales 1,089,567 1,213,678

GROSS PROFIT 564,993 763,106

Operating Expenses 408,978 546,789

OPERATING PROFIT 156,015 216,317

Other Expenses 78,989 97,898

PROFIT BEFORE TAX 77,026 118,419

Tax on profit 15,405 23,684

PROFIT FOR THE YEAR 61,621 94,735

Dividends paid 50,000 80,000

RETAINED PROFIT AT 31 DECEMBER 11,621 14,735

6 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0