Page 57 - A Level Business Studies - Financial Analysis Tasks

P. 57

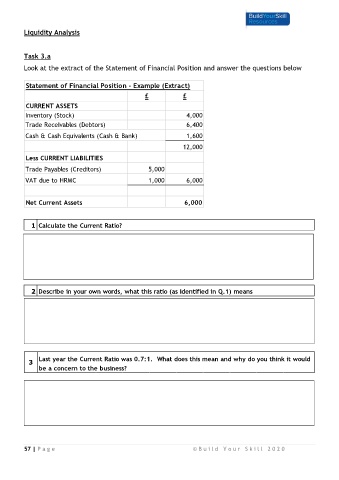

Liquidity Analysis

Task 3.a

Look at the extract of the Statement of Financial Position and answer the questions below

Statement of Financial Position - Example (Extract)

£ £

CURRENT ASSETS

Inventory (Stock) 4,000

Trade Receivables (Debtors) 6,400

Cash & Cash Equivalents (Cash & Bank) 1,600

12,000

Less CURRENT LIABILITIES

Trade Payables (Creditors) 5,000

VAT due to HRMC 1,000 6,000

Net Current Assets 6,000

1 Calculate the Current Ratio?

2 Describe in your own words, what this ratio (as identified in Q.1) means

3 Last year the Current Ratio was 0.7:1. What does this mean and why do you think it would

be a concern to the business?

57 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0