Page 53 - A Level Business Studies - Financial Analysis Tasks

P. 53

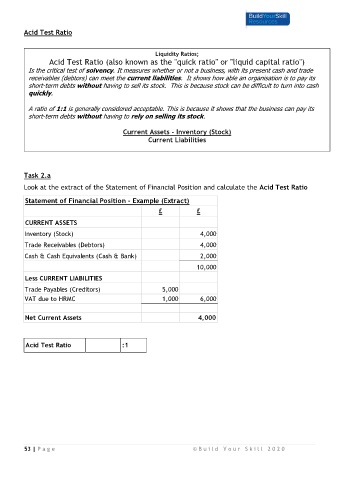

Acid Test Ratio

Liquidity Ratios;

Acid Test Ratio (also known as the "quick ratio" or "liquid capital ratio")

Is the critical test of solvency. It measures whether or not a business, with its present cash and trade

receivables (debtors) can meet the current liabilities. It shows how able an organisation is to pay its

short-term debts without having to sell its stock. This is because stock can be difficult to turn into cash

quickly.

A ratio of 1:1 is generally considered acceptable. This is because it shows that the business can pay its

short-term debts without having to rely on selling its stock.

Current Assets - Inventory (Stock)

Current Liabilities

Task 2.a

Look at the extract of the Statement of Financial Position and calculate the Acid Test Ratio

Statement of Financial Position - Example (Extract)

£ £

CURRENT ASSETS

Inventory (Stock) 4,000

Trade Receivables (Debtors) 4,000

Cash & Cash Equivalents (Cash & Bank) 2,000

10,000

Less CURRENT LIABILITIES

Trade Payables (Creditors) 5,000

VAT due to HRMC 1,000 6,000

Net Current Assets 4,000

Acid Test Ratio :1

53 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0