Page 49 - A Level Business Studies - Financial Analysis Tasks

P. 49

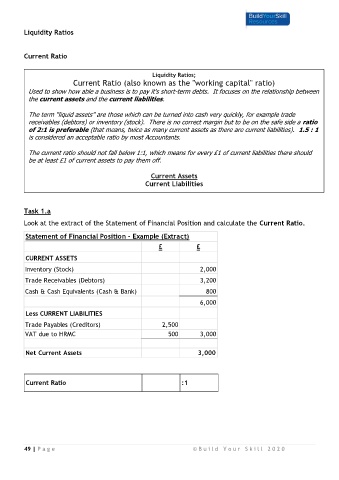

Liquidity Ratios

Current Ratio

Liquidity Ratios;

Current Ratio (also known as the "working capital" ratio)

Used to show how able a business is to pay it's short-term debts. It focuses on the relationship between

the current assets and the current liabilities.

The term "liquid assets" are those which can be turned into cash very quickly, for example trade

receivables (debtors) or inventory (stock). There is no correct margin but to be on the safe side a ratio

of 2:1 is preferable (that means, twice as many current assets as there are current liabilities). 1.5 : 1

is considered an acceptable ratio by most Accountants.

The current ratio should not fall below 1:1, which means for every £1 of current liabilities there should

be at least £1 of current assets to pay them off.

Current Assets

Current Liabilities

Task 1.a

Look at the extract of the Statement of Financial Position and calculate the Current Ratio.

Statement of Financial Position - Example (Extract)

£ £

CURRENT ASSETS

Inventory (Stock) 2,000

Trade Receivables (Debtors) 3,200

Cash & Cash Equivalents (Cash & Bank) 800

6,000

Less CURRENT LIABILITIES

Trade Payables (Creditors) 2,500

VAT due to HRMC 500 3,000

Net Current Assets 3,000

Current Ratio :1

49 | P a g e © B u i l d Y o u r S k i l l 2 0 2 0