Page 6 - U.S, International Taxation Inbound - Outbound Transactions_Neat

P. 6

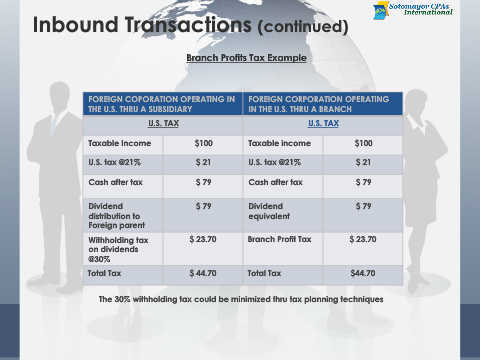

Inbound Transactions (continued)

Branch Profits Tax Example

FOREIGN COPORATION OPERATING IN FOREIGN CORPORATION OPERATING

THE U.S. THRU A SUBSIDIARY IN THE U.S. THRU A BRANCH

U.S. TAX U.S. TAX

Taxable Income $100 Taxable income $100

U.S. tax @21% $ 21 U.S. tax @21% $ 21

Cash after tax $ 79 Cash after tax $ 79

Dividend $ 79 Dividend $ 79

distribution to equivalent

Foreign parent

Withholding tax $ 23.70 Branch Profit Tax $ 23.70

on dividends

@30%

Total Tax $ 44.70 Total Tax $44.70

The 30% withholding tax could be minimized thru tax planning techniques