Page 9 - U.S, International Taxation Inbound - Outbound Transactions_Neat

P. 9

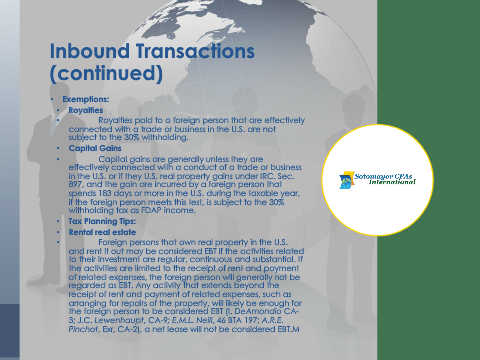

Inbound Transactions

(continued)

• Exemptions:

• Royalties

• Royalties paid to a foreign person that are effectively

connected with a trade or business in the U.S. are not

subject to the 30% withholding.

• Capital Gains

• Capital gains are generally unless they are

effectively connected with a conduct of a trade or business

in the U.S. or if they U.S. real property gains under IRC. Sec.

897, and the gain are incurred by a foreign person that

spends 183 days or more in the U.S. during the taxable year,

if the foreign person meets this test, is subject to the 30%

withholding tax as FDAP income.

• Tax Planning Tips:

• Rental real estate

• Foreign persons that own real property in the U.S.

and rent it out may be considered EBT if the activities related

to their investment are regular, continuous and substantial. If

the activities are limited to the receipt of rent and payment

of related expenses, the foreign person will generally not be

regarded as EBT. Any activity that extends beyond the

receipt of rent and payment of related expenses, such as

arranging for repairs of the property, will likely be enough for

the foreign person to be considered EBT (I. DeAmondio CA-

3; J.C. Lewenhaupt, CA-9; E.M.L. Neill, 46 BTA 197; A.R.E.

Pinchot, Exr, CA-2), a net lease will not be considered EBT.M