Page 7 - Cover Letter and Medicare Evaluation for Jamie Marshall

P. 7

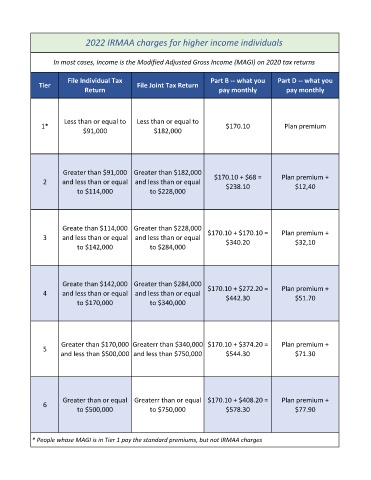

2022 IRMAA charges for higher income individuals

In most cases, income is the Modified Adjusted Gross Income (MAGI) on 2020 tax returns

File Individual Tax Part B -- what you Part D -- what you

Tier File Joint Tax Return

Return pay monthly pay monthly

Less than or equal to Less than or equal to

1* $170.10 Plan premium

$91,000 $182,000

Greater than $91,000 Greater than $182,000 $170.10 + $68 = Plan premium +

2 and less than or equal and less than or equal $238.10 $12,40

to $114,000 to $228,000

Greate than $114,000 Greater than $228,000

3 and less than or equal and less than or equal $170.10 + $170.10 = Plan premium +

$32,10

$340.20

to $142,000 to $284,000

Greate than $142,000 Greater than $284,000

4 and less than or equal and less than or equal $170.10 + $272.20 = Plan premium +

$51.70

$442.30

to $170,000 to $340,000

Greater than $170,000 Greaterr than $340,000 $170.10 + $374.20 = Plan premium +

5

and less than $500,000 and less than $750,000 $544.30 $71.30

Greater than or equal Greaterr than or equal $170.10 + $408.20 = Plan premium +

6

to $500,000 to $750,000 $578.30 $77.90

* People whose MAGI is in Tier 1 pay the standard premiums, but not IRMAA charges