Page 14 - Cover Letter and Medicare Evaluation for Heidi Bathon

P. 14

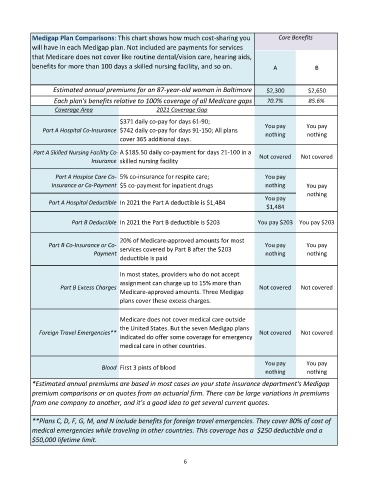

Medigap Plan Comparisons: This chart shows how much cost-sharing you Core Benefits

will have in each Medigap plan. Not included are payments for services

that Medicare does not cover like routine dental/vision care, hearing aids,

benefits for more than 100 days a skilled nursing facility, and so on. A B

Estimated annual premiums for an 87-year-old woman in Baltimore $2,300 $2,650

Each plan's benefits relative to 100% coverage of all Medicare gaps 70.7% 85.6%

Coverage Area 2021 Coverage Gap

$371 daily co-pay for days 61-90;

Part A Hospital Co-Insurance $742 daily co-pay for days 91-150; All plans You pay You pay

nothing

nothing

cover 365 additional days.

Part A Skilled Nursing Facility Co- A $185.50 daily co-payment for days 21-100 in a Not covered Not covered

Insurance skilled nursing facility

Part A Hospice Care Co- 5% co-insurance for respite care; You pay

Insurance or Co-Payment $5 co-payment for inpatient drugs nothing You pay

nothing

You pay

Part A Hospital Deductible In 2021 the Part A deductible is $1,484

$1,484

Part B Deductible In 2021 the Part B deductible is $203 You pay $203 You pay $203

20% of Medicare-approved amounts for most

Part B Co-Insurance or Co- services covered by Part B after the $203 You pay You pay

Payment nothing nothing

deductible is paid

In most states, providers who do not accept

assignment can charge up to 15% more than

Part B Excess Charges Not covered Not covered

Medicare-approved amounts. Three Medigap

plans cover these excess charges.

Medicare does not cover medical care outside

the United States. But the seven Medigap plans

Foreign Travel Emergencies** Not covered Not covered

indicated do offer some coverage for emergency

medical care in other countries.

You pay You pay

Blood First 3 pints of blood

nothing nothing

*Estimated annual premiums are based in most cases on your state insurance department's Medigap

premium comparisons or on quotes from an actuarial firm. There can be large variations in premiums

from one company to another, and it's a good idea to get several current quotes.

**Plans C, D, F, G, M, and N include benefits for foreign travel emergencies. They cover 80% of cost of

medical emergencies while traveling in other countries. This coverage has a $250 deductible and a

$50,000 lifetime limit.

6