Page 52 - Demo

P. 52

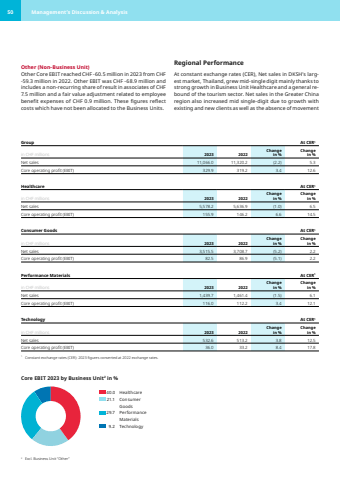

50 Management%u2019s Discussion & Analysis 2 Excl. Business Unit %u201cOther%u201dOther (Non-Business Unit)Other Core EBIT reached CHF -60.5 million in 2023 from CHF -59.3 million in 2022. Other EBIT was CHF -68.9 million and includes a non-recurring share of result in associates of CHF 7.5 million and a fair value adjustment related to employee benefit expenses of CHF 0.9 million. These figures reflect costs which have not been allocated to the Business Units.Regional PerformanceAt constant exchange rates (CER), Net sales in DKSH%u2019s largest market, Thailand, grew mid-single digit mainly thanks to strong growth in Business Unit Healthcare and a general rebound of the tourism sector. Net sales in the Greater China region also increased mid single-digit due to growth with existing and new clients as well as the absence of movement Group At CER1in CHF millions 2023 2022Change in %Change in %Net sales 11,066.0 11,320.2 (2.2) 5.3 Core operating profit (EBIT) 329.9 319.2 3.4 12.6 Healthcare At CER1in CHF millions 2023 2022Change in %Change in %Net sales 5,578.2 5,636.9 (1.0) 6.5 Core operating profit (EBIT) 155.9 146.2 6.6 14.5 Consumer Goods At CER1in CHF millions 2023 2022Change in %Change in %Net sales 3,515.5 3,708.7 (5.2) 2.2 Core operating profit (EBIT) 82.5 86.9 (5.1) 2.2 Performance Materials At CER1in CHF millions 2023 2022Change in %Change in %Net sales 1,439.7 1,461.4 (1.5) 6.1 Core operating profit (EBIT) 116.0 112.2 3.4 12.1 Technology At CER1in CHF millions 2023 2022Change in %Change in %Net sales 532.6 513.2 3.8 12.5 Core operating profit (EBIT) 36.0 33.2 8.4 17.8 1 Constant exchange rates (CER): 2023 figures converted at 2022 exchange rates.Core EBIT 2023 by Business Unit2 in %40.0 Healthcare21.1 ConsumerGoods 29.7 PerformanceMaterials9.2 Technology