Page 56 - Demo

P. 56

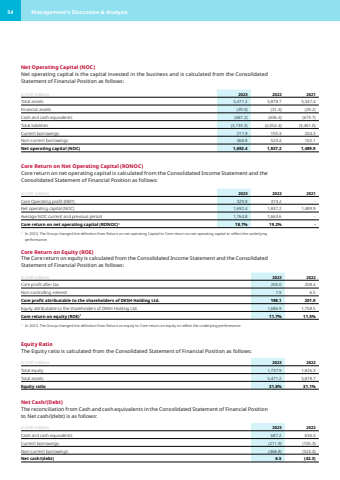

54 Management%u2019s Discussion & Analysis Net Operating Capital (NOC)Net operating capital is the capital invested in the business and is calculated from the Consolidated Statement of Financial Position as follows:in CHF millions 2023 2022 2021Total assets 5,471.2 5,878.7 5,347.4 Financial assets (39.0) (31.4) (29.2) Cash and cash equivalents (687.2) (636.4) (673.7) Total liabilities (3,733.3) (4,052.4) (3,461.0) Current borrowings 211.9 155.3 204.3 Non-current borrowings 468.8 523.4 102.1 Net operating capital (NOC) 1,692.4 1,837.2 1,489.9 Core Return on Net Operating Capital (RONOC)Core return on net operating capital is calculated from the Consolidated Income Statement and the Consolidated Statement of Financial Position as follows:in CHF millions 2023 2022 2021Core Operating profit (EBIT) 329.9 319.2 -Net operating capital (NOC) 1,692.4 1,837.2 1,489.9 Average NOC current and previous period 1,764.8 1,663.6 -Core return on net operating capital (RONOC)1 18.7% 19.2% -1 In 2023, The Group changed the definition from Return on net operating Capital to Core return on net operating capital to reflect the underlying performance.Core Return on Equity (ROE)The Core return on equity is calculated from the Consolidated Income Statement and the Consolidated Statement of Financial Position as follows:in CHF millions 2023 2022Core profit after tax 206.0 208.4 Non-controlling interest 7.9 6.5 Core profit attributable to the shareholders of DKSH Holding Ltd. 198.1 201.9 Equity attributable to the shareholders of DKSH Holding Ltd. 1,686.9 1,758.5 Core return on equity (ROE)1 11.7% 11.5%1 In 2023, The Group changed the definition from Return on equity to Core return on equity to reflect the underlying performance.Equity RatioThe Equity ratio is calculated from the Consolidated Statement of Financial Position as follows:in CHF millions 2023 2022Total equity 1,737.9 1,826.3 Total assets 5,471.2 5,878.7 Equity ratio 31.8% 31.1%Net Cash/(Debt)The reconciliation from Cash and cash equivalents in the Consolidated Statement of Financial Position to Net cash/(debt) is as follows:in CHF millions 2023 2022Cash and cash equivalents 687.2 636.4 Current borrowings (211.9) (155.3) Non-current borrowings (468.8) (523.4) Net cash/(debt) 6.5 (42.3)