Page 54 - Demo

P. 54

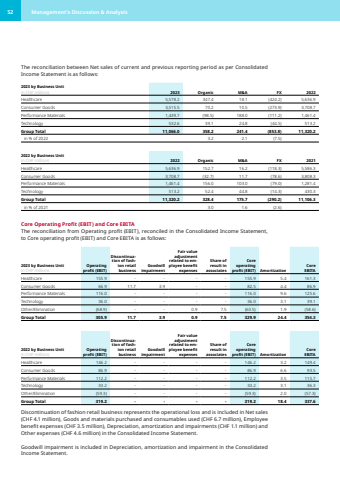

52 Management%u2019s Discussion & Analysis The reconciliation between Net sales of current and previous reporting period as per Consolidated Income Statement is as follows:2023 by Business Unit in CHF millions 2023 Organic M&A FX 2022Healthcare 5,578.2 347.4 18.1 (424.2) 5,636.9 Consumer Goods 3,515.5 70.2 10.5 (273.9) 3,708.7 Performance Materials 1,439.7 (98.5) 188.0 (111.2) 1,461.4 Technology 532.6 39.1 24.8 (44.5) 513.2 Group Total 11,066.0 358.2 241.4 (853.8) 11,320.2 in % of 2022 3.2 2.1 (7.5)2022 by Business Unit in CHF millions 2022 Organic M&A FX 2021Healthcare 5,636.9 152.7 16.2 (118.3) 5,586.3 Consumer Goods 3,708.7 (32.7) 11.7 (78.6) 3,808.3 Performance Materials 1,461.4 156.0 103.0 (79.0) 1,281.4 Technology 513.2 52.4 44.8 (14.3) 430.3 Group Total 11,320.2 328.4 175.7 (290.2) 11,106.3 in % of 2021 3.0 1.6 (2.6)Core Operating Profit (EBIT) and Core EBITAThe reconciliation from Operating profit (EBIT), reconciled in the Consolidated Income Statement, to Core operating profit (EBIT) and Core EBITA is as follows:2023 by Business Unit in CHF millionsOperating profit (EBIT)Discontinuation of fashion retail businessGoodwill impairmentFair value adjustment related to employee benefit expensesShare of result in associatesCore operating profit (EBIT) AmortizationCore EBITAHealthcare 155.9 - - - - 155.9 5.4 161.3 Consumer Goods 66.9 11.7 3.9 - - 82.5 4.4 86.9 Performance Materials 116.0 - - - - 116.0 9.6 125.6 Technology 36.0 - - - - 36.0 3.1 39.1 Other/Elimination (68.9) - - 0.9 7.5 (60.5) 1.9 (58.6) Group Total 305.9 11.7 3.9 0.9 7.5 329.9 24.4 354.3 2022 by Business Unit in CHF millionsOperating profit (EBIT)Discontinuation of fashion retail businessGoodwill impairmentFair value adjustment related to employee benefit expensesShare of result in associatesCore operating profit (EBIT) AmortizationCore EBITAHealthcare 146.2 - - - - 146.2 3.2 149.4 Consumer Goods 86.9 - - - - 86.9 6.6 93.5 Performance Materials 112.2 - - - - 112.2 3.5 115.7 Technology 33.2 - - - - 33.2 3.1 36.3 Other/Elimination (59.3) - - - - (59.3) 2.0 (57.3) Group Total 319.2 - - - - 319.2 18.4 337.6 Discontinuation of fashion retail business represents the operational loss and is included in Net sales (CHF 4.1 million), Goods and materials purchased and consumables used (CHF 6.7 million), Employee benefit expenses (CHF 3.5 million), Depreciation, amortization and impairments (CHF 1.1 million) and Other expenses (CHF 4.6 million) in the Consolidated Income Statement. Goodwill impairment is included in Depreciation, amortization and impairment in the Consolidated Income Statement.