Page 61 - Demo

P. 61

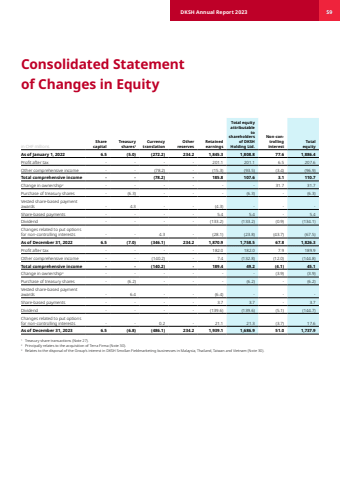

in CHF millionsShare capitalTreasury shares1Currency translationOther reservesRetained earningsTotal equity attributable to shareholders of DKSH Holding Ltd.Non-controlling interest Total equityAs of January 1, 2022 6.5 (5.0) (272.2) 234.2 1,845.3 1,808.8 77.6 1,886.4 Profit after tax - - - - 201.1 201.1 6.5 207.6 Other comprehensive income - - (78.2) - (15.3) (93.5) (3.4) (96.9) Total comprehensive income - - (78.2) - 185.8 107.6 3.1 110.7 Change in ownership2 - - - - - - 31.7 31.7 Purchase of treasury shares - (6.3) - - - (6.3) - (6.3) Vested share-based payment awards - 4.3 - - (4.3) - - -Share-based payments - - - - 5.4 5.4 - 5.4 Dividend - - - - (133.2) (133.2) (0.9) (134.1) Changes related to put options for non-controlling interests - - 4.3 - (28.1) (23.8) (43.7) (67.5) As of December 31, 2022 6.5 (7.0) (346.1) 234.2 1,870.9 1,758.5 67.8 1,826.3 Profit after tax - - - - 182.0 182.0 7.9 189.9 Other comprehensive income - - (140.2) - 7.4 (132.8) (12.0) (144.8) Total comprehensive income - - (140.2) - 189.4 49.2 (4.1) 45.1 Change in ownership3 - - - - - - (3.9) (3.9) Purchase of treasury shares - (6.2) - - - (6.2) - (6.2) Vested share-based payment awards - 6.4 - - (6.4) - - -Share-based payments - - - - 3.7 3.7 - 3.7 Dividend - - - - (139.6) (139.6) (5.1) (144.7) Changes related to put options for non-controlling interests - - 0.2 - 21.1 21.3 (3.7) 17.6 As of December 31, 2023 6.5 (6.8) (486.1) 234.2 1,939.1 1,686.9 51.0 1,737.9 1 Treasury share transactions (Note 27).2 Principally relates to the acquisition of Terra Firma (Note 30). 3 Relates to the disposal of the Group%u2019s interest in DKSH Smollan Fieldmarketing businesses in Malaysia, Thailand, Taiwan and Vietnam (Note 30). Consolidated Statement of Changes in EquityDKSH Annual Report 2023 59