Page 62 - Demo

P. 62

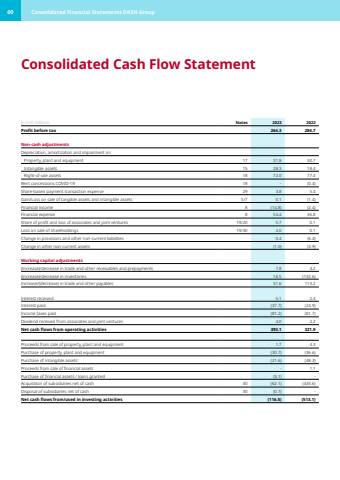

in CHF millions Notes 2023 2022Profit before tax 264.3 284.7 Non-cash adjustmentsDepreciation, amortization and impairment onProperty, plant and equipment 17 31.8 30.7 Intangible assets 15 28.3 18.4 Right-of-use assets 18 72.0 77.4 Rent concessions COVID-19 18 - (0.4) Share-based payment transaction expense 29 3.8 5.4 Gain/Loss on sale of tangible assets and intangible assets 5/7 0.1 (1.4) Financial income 8 (14.8) (2.4) Financial expense 8 54.4 36.8 Share of profit and loss of associates and joint ventures 19/20 5.7 0.1 Loss on sale of shareholdings 19/30 2.0 0.1 Change in provisions and other non-current liabilities 0.4 (6.4) Change in other non-current assets (1.0) (3.9) Working capital adjustments(Increase)/decrease in trade and other receivables and prepayments 7.8 4.2 (Increase)/decrease in inventories 16.5 (132.6) Increase/(decrease) in trade and other payables 31.6 113.2 Interest received 5.1 2.4 Interest paid (37.7) (24.9) Income taxes paid (81.2) (81.7) Dividend received from associates and joint ventures 4.0 2.2 Net cash flows from operating activities 393.1 321.9 Proceeds from sale of property, plant and equipment 1.7 4.3 Purchase of property, plant and equipment (30.7) (36.6) Purchase of intangible assets1 (21.6) (48.3) Proceeds from sale of financial assets - 1.1 Purchase of financial assets / loans granted (3.1) -Acquisition of subsidiaries net of cash 30 (62.1) (433.6) Disposal of subsidiaries net of cash 30 (0.7) -Net cash flows from/used in investing activities (116.5) (513.1) Consolidated Cash Flow Statement60 Consolidated Financial Statements DKSH Group