Page 77 - Demo

P. 77

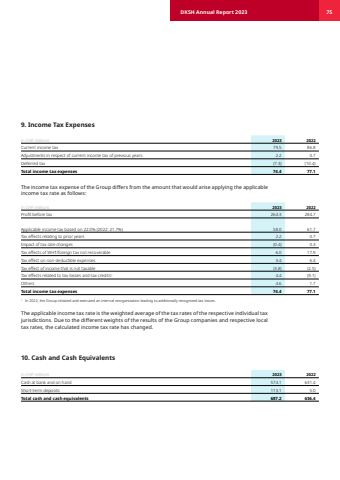

9. Income Tax Expensesin CHF millions 2023 2022Current income tax 79.5 86.8 Adjustments in respect of current income tax of previous years 2.2 0.7 Deferred tax (7.3) (10.4) Total income tax expenses 74.4 77.1 The income tax expense of the Group differs from the amount that would arise applying the applicableincome tax rate as follows:in CHF millions 2023 2022Profit before tax 264.3 284.7 Applicable income tax based on 22.0% (2022: 21.7%) 58.0 61.7 Tax effects relating to prior years 2.2 0.7 Impact of tax rate changes (0.4) 0.3 Tax effects of WHT/foreign tax not recoverable 6.0 17.9 Tax effect on non-deductible expenses 3.4 6.4 Tax effect of income that is not taxable (3.8) (2.5) Tax effects related to tax losses and tax credits1 4.4 (9.1) Others 4.6 1.7 Total income tax expenses 74.4 77.1 1 In 2022, the Group initiated and executed an internal reorganization leading to additionally recognized tax losses.The applicable income tax rate is the weighted average of the tax rates of the respective individual tax jurisdictions. Due to the different weights of the results of the Group companies and respective local tax rates, the calculated income tax rate has changed.10. Cash and Cash Equivalentsin CHF millions 2023 2022Cash at bank and on hand 574.1 631.4 Short-term deposits 113.1 5.0 Total cash and cash equivalents 687.2 636.4 DKSH Annual Report 2023 75