Page 81 - Demo

P. 81

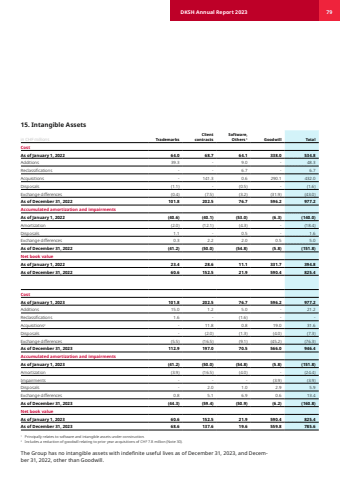

15. Intangible Assetsin CHF millions TrademarksClient contractsSoftware, Others 1 Goodwill TotalCostAs of January 1, 2022 64.0 68.7 64.1 338.0 534.8 Additions 39.3 - 9.0 - 48.3 Reclassifications - - 6.7 - 6.7 Acquisitions - 141.3 0.6 290.1 432.0 Disposals (1.1) - (0.5) - (1.6) Exchange differences (0.4) (7.5) (3.2) (31.9) (43.0) As of December 31, 2022 101.8 202.5 76.7 596.2 977.2 Accumulated amortization and impairmentsAs of January 1, 2022 (40.6) (40.1) (53.0) (6.3) (140.0) Amortization (2.0) (12.1) (4.3) - (18.4) Disposals 1.1 - 0.5 - 1.6 Exchange differences 0.3 2.2 2.0 0.5 5.0 As of December 31, 2022 (41.2) (50.0) (54.8) (5.8) (151.8) Net book valueAs of January 1, 2022 23.4 28.6 11.1 331.7 394.8 As of December 31, 2022 60.6 152.5 21.9 590.4 825.4 CostAs of January 1, 2023 101.8 202.5 76.7 596.2 977.2 Additions 15.0 1.2 5.0 - 21.2 Reclassifications 1.6 - (1.6) - -Acquisitions2 - 11.8 0.8 19.0 31.6 Disposals - (2.0) (1.3) (4.0) (7.3) Exchange differences (5.5) (16.5) (9.1) (45.2) (76.3) As of December 31, 2023 112.9 197.0 70.5 566.0 946.4 Accumulated amortization and impairmentsAs of January 1, 2023 (41.2) (50.0) (54.8) (5.8) (151.8) Amortization (3.9) (16.5) (4.0) - (24.4) Impairments - - - (3.9) (3.9) Disposals - 2.0 1.0 2.9 5.9 Exchange differences 0.8 5.1 6.9 0.6 13.4 As of December 31, 2023 (44.3) (59.4) (50.9) (6.2) (160.8) Net book valueAs of January 1, 2023 60.6 152.5 21.9 590.4 825.4 As of December 31, 2023 68.6 137.6 19.6 559.8 785.6 1 Principally relates to software and intangible assets under construction.2 Includes a reduction of goodwill relating to prior year acquisitions of CHF 7.8 million (Note 30).The Group has no intangible assets with indefinite useful lives as of December 31, 2023, and December 31, 2022, other than Goodwill.DKSH Annual Report 2023 79