Page 82 - Demo

P. 82

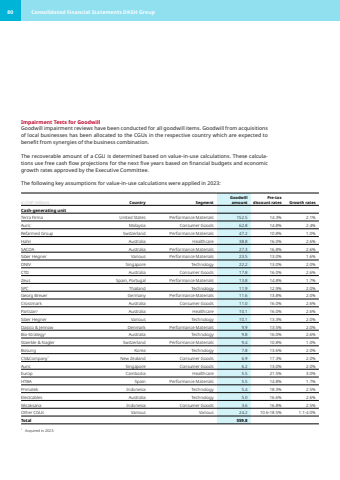

Impairment Tests for GoodwillGoodwill impairment reviews have been conducted for all goodwill items. Goodwill from acquisitions of local businesses has been allocated to the CGUs in the respective country which are expected to benefit from synergies of the business combination. The recoverable amount of a CGU is determined based on value-in-use calculations. These calculations use free cash flow projections for the next five years based on financial budgets and economic growth rates approved by the Executive Committee.The following key assumptions for value-in-use calculations were applied in 2023:in CHF millions Country SegmentGoodwill amountPre-tax discount rates Growth ratesCash-generating unitTerra Firma United States Performance Materials 152.5 14.3% 2.1%Auric Malaysia Consumer Goods 62.8 14.8% 2.4%Refarmed Group Switzerland Performance Materials 47.2 10.8% 1.0%Hahn Australia Healthcare 38.8 16.0% 2.6%SACOA Australia Performance Materials 27.3 16.8% 2.6%Siber Hegner Various Performance Materials 23.5 13.0% 1.6%DNIV Singapore Technology 22.2 13.0% 2.0%CTD Australia Consumer Goods 17.8 16.0% 2.6%Zeus Spain, Portugal Performance Materials 13.8 14.8% 1.7%SPC Thailand Technology 11.9 12.9% 2.0%Georg Breuer Germany Performance Materials 11.6 13.8% 2.0%Crossmark Australia Consumer Goods 11.0 16.0% 2.6%Partizan1 Australia Healthcare 10.1 16.0% 2.6%Siber Hegner Various Technology 10.1 13.3% 2.0%Dasico & Jennow Denmark Performance Materials 9.9 13.5% 2.0%Bio-Strategy1 Australia Technology 9.8 16.0% 2.6%Staerkle & Nagler Switzerland Performance Materials 9.4 10.8% 1.0%Bosung Korea Technology 7.8 13.6% 2.0%CS&Company1 New Zealand Consumer Goods 6.9 17.3% 2.0%Auric Singapore Consumer Goods 6.2 13.0% 2.0%Europ Cambodia Healthcare 5.5 21.5% 3.0%HTBA Spain Performance Materials 5.5 14.8% 1.7%Primatek Indonesia Technology 5.4 18.3% 2.5%Electcables Australia Technology 5.0 16.6% 2.6%Wicaksana Indonesia Consumer Goods 3.6 16.8% 2.5%Other CGUs Various Various 24.2 10.6-18.5% 1.1-4.0%Total 559.8 1 Acquired in 2023.80 Consolidated Financial Statements DKSH Group