Page 81 - Demo

P. 81

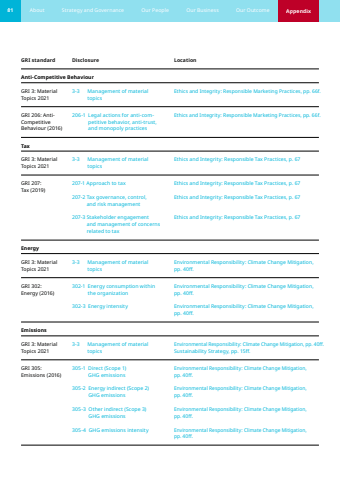

81 About Strategy and Governance Our People Our Business Our Outcome AppendixGRI standard Disclosure LocationGRI 3: Material Topics 2021GRI 3: Material Topics 2021TaxGRI 207: Tax (2019) GRI 206: AntiCompetitive Behaviour (2016)3-3 Management of material topics3-3 Management of material topics207-1 Approach to tax207-2 Tax governance, control, and risk management207-3 Stakeholder engagement and management of concerns related to tax206-1 Legal actions for anti-competitive behavior, anti-trust, and monopoly practicesEthics and Integrity: Responsible Tax Practices, p. 67Ethics and Integrity: Responsible Marketing Practices, pp. 66f.Ethics and Integrity: Responsible Tax Practices, p. 67Ethics and Integrity: Responsible Tax Practices, p. 67Ethics and Integrity: Responsible Tax Practices, p. 67Ethics and Integrity: Responsible Marketing Practices, pp. 66f.Anti-Competitive BehaviourGRI 3: Material Topics 2021GRI 3: Material Topics 2021GRI 305: Emissions (2016)GRI 302: Energy (2016)3-3 Management of material topics3-3 Management of material topics305-1 Direct (Scope 1) GHG emissions305-2 Energy indirect (Scope 2) GHG emissions305-3 Other indirect (Scope 3) GHG emissions305-4 GHG emissions intensity302-1 Energy consumption within the organization302-3 Energy intensityEnvironmental Responsibility: Climate Change Mitigation, pp. 40ff. Sustainability Strategy, pp. 15ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.Environmental Responsibility: Climate Change Mitigation, pp. 40ff.EnergyEmissions