Page 14 - Yaskawa 2022 Open Enrollment Guide

P. 14

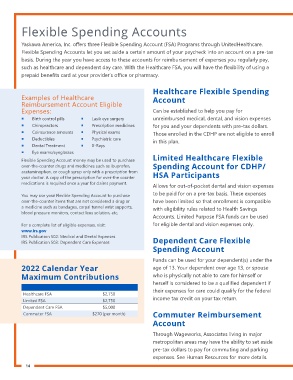

Flexible Spending Accounts

Yaskawa America, Inc. ofers three Flexible Spending Account (FSA) Programs through UnitedHealthcare.

Flexible Spending Accounts let you set aside a certain amount of your paycheck into an account on a pre-tax

basis. During the year you have access to these accounts for reimbursement of expenses you regularly pay,

such as healthcare and dependent day care. With the Healthcare FSA, you will have the lexibility of using a

prepaid beneits card at your provider’s oice or pharmacy.

Healthcare Flexible Spending

Examples of Healthcare Account

Reimbursement Account Eligible

Expenses: Can be established to help you pay for

Birth control pills Lasik eye surgery unreimbursed medical, dental, and vision expenses

Chiropractors Prescription medicines for you and your dependents with pre-tax dollars.

Coinsurance amounts Physical exams Those enrolled in the CDHP are not eligible to enroll

Deductibles Psychiatric care in this plan.

Dental Treatment X-Rays

Eye exams/eyeglasses

Flexible Spending Account money may be used to purchase Limited Healthcare Flexible

over-the-counter drugs and medicines such as ibuprofen, Spending Account for CDHP/

acetaminophen, or cough syrup only with a prescription from HSA Participants

your doctor. A copy of the prescription for over-the counter

medications is required once a year for claims payment.

Allows for out-of-pocket dental and vision expenses

You may use your Flexible Spending Account to purchase to be paid for on a pre-tax basis. These expenses

over-the-counter items that are not considered a drug or have been limited so that enrollment is compatible

a medicine such as bandages, carpal tunnel wrist supports, with eligibility rules related to Health Savings

blood pressure monitors, contact lens solution, etc.

Accounts. Limited Purpose FSA funds can be used

For a complete list of eligible expenses, visit: for eligible dental and vision expenses only.

www.irs.gov

IRS Publication 502: Medical and Dental Expenses

IRS Publication 503: Dependent Care Expenses Dependent Care Flexible

Spending Account

Funds can be used for your dependent(s) under the

2022 Calendar Year age of 13. Your dependent over age 13, or spouse

Maximum Contributions who is physically not able to care for himself or

herself is considered to be a qualiied dependent if

their expenses for care could qualify for the federal

Healthcare FSA $2,750

Limited FSA $2,750 income tax credit on your tax return.

Dependent Care FSA $5,000

Commuter FSA $270 (per month) Commuter Reimbursement

Account

Through Wageworks, Associates living in major

metropolitan areas may have the ability to set aside

pre-tax dollars to pay for commuting and parking

expenses. See Human Resources for more details.

14

Yaskawa America, Inc. ofers three Flexible Spending Account (FSA) Programs through UnitedHealthcare.

Flexible Spending Accounts let you set aside a certain amount of your paycheck into an account on a pre-tax

basis. During the year you have access to these accounts for reimbursement of expenses you regularly pay,

such as healthcare and dependent day care. With the Healthcare FSA, you will have the lexibility of using a

prepaid beneits card at your provider’s oice or pharmacy.

Healthcare Flexible Spending

Examples of Healthcare Account

Reimbursement Account Eligible

Expenses: Can be established to help you pay for

Birth control pills Lasik eye surgery unreimbursed medical, dental, and vision expenses

Chiropractors Prescription medicines for you and your dependents with pre-tax dollars.

Coinsurance amounts Physical exams Those enrolled in the CDHP are not eligible to enroll

Deductibles Psychiatric care in this plan.

Dental Treatment X-Rays

Eye exams/eyeglasses

Flexible Spending Account money may be used to purchase Limited Healthcare Flexible

over-the-counter drugs and medicines such as ibuprofen, Spending Account for CDHP/

acetaminophen, or cough syrup only with a prescription from HSA Participants

your doctor. A copy of the prescription for over-the counter

medications is required once a year for claims payment.

Allows for out-of-pocket dental and vision expenses

You may use your Flexible Spending Account to purchase to be paid for on a pre-tax basis. These expenses

over-the-counter items that are not considered a drug or have been limited so that enrollment is compatible

a medicine such as bandages, carpal tunnel wrist supports, with eligibility rules related to Health Savings

blood pressure monitors, contact lens solution, etc.

Accounts. Limited Purpose FSA funds can be used

For a complete list of eligible expenses, visit: for eligible dental and vision expenses only.

www.irs.gov

IRS Publication 502: Medical and Dental Expenses

IRS Publication 503: Dependent Care Expenses Dependent Care Flexible

Spending Account

Funds can be used for your dependent(s) under the

2022 Calendar Year age of 13. Your dependent over age 13, or spouse

Maximum Contributions who is physically not able to care for himself or

herself is considered to be a qualiied dependent if

their expenses for care could qualify for the federal

Healthcare FSA $2,750

Limited FSA $2,750 income tax credit on your tax return.

Dependent Care FSA $5,000

Commuter FSA $270 (per month) Commuter Reimbursement

Account

Through Wageworks, Associates living in major

metropolitan areas may have the ability to set aside

pre-tax dollars to pay for commuting and parking

expenses. See Human Resources for more details.

14