Page 17 - Yaskawa 2022 Open Enrollment Guide

P. 17

2022 Benefits Guide

Disability

Yaskawa America, Inc. provides the following beneits at no cost to employees working 30 hours:

Short Term Disability Long Term Disability

Eligible Associates are provided Short Term Disability What would you do if your paychecks stopped?

coverage paid by Yaskawa America, Inc. To be If you are like most Americans, you insure your

provided paid short term disability you must be car, your home, and your health. What about your

absent from work ive (5) consecutive days as a salary? How long could you and your family go

result of illness or injury. The beneit is as follows: without a paycheck if you were to become disabled

and unable to work?

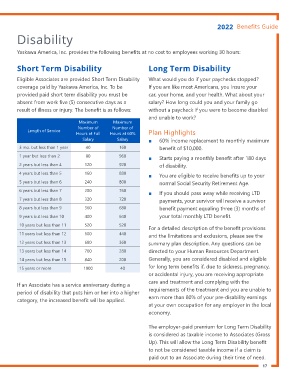

Maximum Maximum

Number of Number of

Length of Service

Hours at Full Hours at 60% Plan Highlights

Salary Salary ■ 60% income replacement to monthly maximum

3 mo. but less than 1 year 40 160 beneit of $10,000.

1 year but less than 2 80 960 ■ Starts paying a monthly beneit after 180 days

2 years but less than 4 120 920 of disability.

4 years but less than 5 160 880 ■ You are eligible to receive beneits up to your

5 years but less than 6 240 800 normal Social Security Retirement Age.

6 years but less than 7 280 760 ■ If you should pass away while receiving LTD

7 years but less than 8 320 720 payments, your survivor will receive a survivor

8 years but less than 9 360 680 beneit payment equaling three (3) months of

9 years but less than 10 400 640 your total monthly LTD beneit.

10 years but less than 11 520 520

For a detailed description of the beneit provisions

11 years but less than 12 600 440 and the limitations and exclusions, please see the

12 years but less than 13 680 360 summary plan description. Any questions can be

13 years but less than 14 760 280 directed to your Human Resources Department.

14 years but less than 15 840 200 Generally, you are considered disabled and eligible

15 years or more 1000 40 for long term beneits if, due to sickness, pregnancy,

or accidental injury, you are receiving appropriate

If an Associate has a service anniversary during a care and treatment and complying with the

period of disability that puts him or her into a higher requirements of the treatment and you are unable to

category, the increased beneit will be applied. earn more than 80% of your pre-disability earnings

at your own occupation for any employer in the local

economy.

The employer-paid premium for Long Term Disability

is considered as taxable income to Associates (Gross

Up). This will allow the Long Term Disability beneit

to not be considered taxable income if a claim is

paid out to an Associate during their time of need.

17

Disability

Yaskawa America, Inc. provides the following beneits at no cost to employees working 30 hours:

Short Term Disability Long Term Disability

Eligible Associates are provided Short Term Disability What would you do if your paychecks stopped?

coverage paid by Yaskawa America, Inc. To be If you are like most Americans, you insure your

provided paid short term disability you must be car, your home, and your health. What about your

absent from work ive (5) consecutive days as a salary? How long could you and your family go

result of illness or injury. The beneit is as follows: without a paycheck if you were to become disabled

and unable to work?

Maximum Maximum

Number of Number of

Length of Service

Hours at Full Hours at 60% Plan Highlights

Salary Salary ■ 60% income replacement to monthly maximum

3 mo. but less than 1 year 40 160 beneit of $10,000.

1 year but less than 2 80 960 ■ Starts paying a monthly beneit after 180 days

2 years but less than 4 120 920 of disability.

4 years but less than 5 160 880 ■ You are eligible to receive beneits up to your

5 years but less than 6 240 800 normal Social Security Retirement Age.

6 years but less than 7 280 760 ■ If you should pass away while receiving LTD

7 years but less than 8 320 720 payments, your survivor will receive a survivor

8 years but less than 9 360 680 beneit payment equaling three (3) months of

9 years but less than 10 400 640 your total monthly LTD beneit.

10 years but less than 11 520 520

For a detailed description of the beneit provisions

11 years but less than 12 600 440 and the limitations and exclusions, please see the

12 years but less than 13 680 360 summary plan description. Any questions can be

13 years but less than 14 760 280 directed to your Human Resources Department.

14 years but less than 15 840 200 Generally, you are considered disabled and eligible

15 years or more 1000 40 for long term beneits if, due to sickness, pregnancy,

or accidental injury, you are receiving appropriate

If an Associate has a service anniversary during a care and treatment and complying with the

period of disability that puts him or her into a higher requirements of the treatment and you are unable to

category, the increased beneit will be applied. earn more than 80% of your pre-disability earnings

at your own occupation for any employer in the local

economy.

The employer-paid premium for Long Term Disability

is considered as taxable income to Associates (Gross

Up). This will allow the Long Term Disability beneit

to not be considered taxable income if a claim is

paid out to an Associate during their time of need.

17