Page 15 - Lockton Total Rewards Practice

P. 15

Optimize

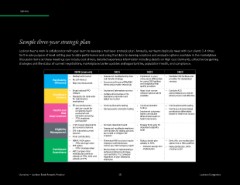

Sample three-year strategic plan

Lockton teams work in collaboration with your team to develop a multiyear strategic plan. Annually, our teams typically meet with our clients 3-4 times

Sample Three-Year Strategic Plan

for the sole purpose of level-setting year to date performance and using that data to develop solutions and evaluate options available in the marketplace.

Discussion items at these meetings can include cost drivers, detailed experience information including details on high cost claimants, collective bargaining

strategies and the status of current negotiations, marketplace/carrier updates and opportunities, population health, and compliance.

2020 (current) 2021 2022 2022

Medical self-insured Assessand recalibrate stop- loss Implement co-pay / MandateCOE facilities and

Purchasing Rx self-insured risk transfer strategy coinsurance differentials providers for designated

services

for using COE facilities

Efficiency Stop loss reinsurance Reassessself-insured TPA/PBM and designated high

terms and provider network(s)

quality providers

Broad national PPO Implement telemedicine service Adopt local narrow Consider ACO

Healthcare network Validate effectiveness of Rx network options where plans/networks by market

available

where proven cost effective

Delivery Mandatory Rx mail-order mandatory mail-order and

for maintenance

adjust as needed

medications

EE annual discounts: Continue biometric testing Continue biometric Continue biometric testing

Health and $40 per month for Add spouses to biometric testing testing Continueoutcomes-based

completing health

contribution differentials

Implement outcomes-

Risk

Improvement evaluation and based contribution based on health risk factors

biometric screening

differentials based on

73% employee health risk factors

participation

1.38 covered dependents Amnesty dependent audit Engage third party for

Eligibility per covered employee Assessand recalibrate employee dependent eligibility

audit

Management 300 estimated covered contributions for adding spouses

as needed to mitigate risk

spouses

4-tier contributions exposure

HDHP / HSA option Eliminated HSA seed and require Reduce dental plan Only offer one medical plan

78% coverage value employee contributions to subsidy to 50% option that is HSA qualified

PPP option receive any XYZ Company match Reinvest savings into Make dental plan 100%

Participant 80% coverage value Start process of implementing a medical plan employee paid

Experience ABC Company total defined contribution strategy;

medical plan premium

subsidy at 70%; total cost cost neutral to XYZ Company

regardless of plan elected by

subsidy at 57% employee

37

Overview — Lockton Total Rewards Practice 15 Lockton Companies

Sample three-year strategic plan

Lockton teams work in collaboration with your team to develop a multiyear strategic plan. Annually, our teams typically meet with our clients 3-4 times

Sample Three-Year Strategic Plan

for the sole purpose of level-setting year to date performance and using that data to develop solutions and evaluate options available in the marketplace.

Discussion items at these meetings can include cost drivers, detailed experience information including details on high cost claimants, collective bargaining

strategies and the status of current negotiations, marketplace/carrier updates and opportunities, population health, and compliance.

2020 (current) 2021 2022 2022

Medical self-insured Assessand recalibrate stop- loss Implement co-pay / MandateCOE facilities and

Purchasing Rx self-insured risk transfer strategy coinsurance differentials providers for designated

services

for using COE facilities

Efficiency Stop loss reinsurance Reassessself-insured TPA/PBM and designated high

terms and provider network(s)

quality providers

Broad national PPO Implement telemedicine service Adopt local narrow Consider ACO

Healthcare network Validate effectiveness of Rx network options where plans/networks by market

available

where proven cost effective

Delivery Mandatory Rx mail-order mandatory mail-order and

for maintenance

adjust as needed

medications

EE annual discounts: Continue biometric testing Continue biometric Continue biometric testing

Health and $40 per month for Add spouses to biometric testing testing Continueoutcomes-based

completing health

contribution differentials

Implement outcomes-

Risk

Improvement evaluation and based contribution based on health risk factors

biometric screening

differentials based on

73% employee health risk factors

participation

1.38 covered dependents Amnesty dependent audit Engage third party for

Eligibility per covered employee Assessand recalibrate employee dependent eligibility

audit

Management 300 estimated covered contributions for adding spouses

as needed to mitigate risk

spouses

4-tier contributions exposure

HDHP / HSA option Eliminated HSA seed and require Reduce dental plan Only offer one medical plan

78% coverage value employee contributions to subsidy to 50% option that is HSA qualified

PPP option receive any XYZ Company match Reinvest savings into Make dental plan 100%

Participant 80% coverage value Start process of implementing a medical plan employee paid

Experience ABC Company total defined contribution strategy;

medical plan premium

subsidy at 70%; total cost cost neutral to XYZ Company

regardless of plan elected by

subsidy at 57% employee

37

Overview — Lockton Total Rewards Practice 15 Lockton Companies