Page 4 - 2017-18 Centennial Benefits Guide Staff

P. 4

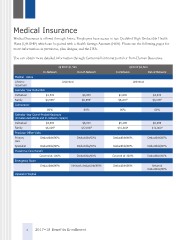

Medical Insurance

Medical Insurance is offered through Aetna. Employees have access to two Qualiied High Deductible Health

Plans (QHDHP) which can be paired with a Health Savings Account (HSA). Please see the following pages for

more information on premiums, plan designs, and the HSA.

You can obtain more detailed information through Centennial’s intranet portal or from Human Resources.

QHDHP $1,500 QHDHP $2,600

In-Network Out-of-Network In-Network Out-of-Network

Medical—Aetna

Lifetime Unlimited Unlimited

maximum

Calendar Year Deductible

Individual $1,500 $3,000 $2,600 $4,000

Family $3,000 1 $6,000 1 $5,200 3 $8,000 3

Coinsurance

80% 60% 80% 60%

Calendar Year Out-of-Pocket Maximum

(includes deductible and in-network copays)

Individual $3,000 $6,000 $5,200 $6,000

Family $6,000 2 $12,000 2 $10,400 4 $12,000 4

Physician Ofice Visits

Primary Deductible/80% Deductible/60% Deductible/80% Deductible/60%

care

Specialist Deductible/80% Deductible/60% Deductible/80% Deductible/60%

Preventive Care Beneit

Covered at 100% Deductible/60% Covered at 100% Deductible/60%

Emergency Room

Deductible/80% Network deductible/80% Deductible/80% Network

Deductible/80%

Inpatient Hospital

4 2017–18 Benefits Enrollment

Medical Insurance is offered through Aetna. Employees have access to two Qualiied High Deductible Health

Plans (QHDHP) which can be paired with a Health Savings Account (HSA). Please see the following pages for

more information on premiums, plan designs, and the HSA.

You can obtain more detailed information through Centennial’s intranet portal or from Human Resources.

QHDHP $1,500 QHDHP $2,600

In-Network Out-of-Network In-Network Out-of-Network

Medical—Aetna

Lifetime Unlimited Unlimited

maximum

Calendar Year Deductible

Individual $1,500 $3,000 $2,600 $4,000

Family $3,000 1 $6,000 1 $5,200 3 $8,000 3

Coinsurance

80% 60% 80% 60%

Calendar Year Out-of-Pocket Maximum

(includes deductible and in-network copays)

Individual $3,000 $6,000 $5,200 $6,000

Family $6,000 2 $12,000 2 $10,400 4 $12,000 4

Physician Ofice Visits

Primary Deductible/80% Deductible/60% Deductible/80% Deductible/60%

care

Specialist Deductible/80% Deductible/60% Deductible/80% Deductible/60%

Preventive Care Beneit

Covered at 100% Deductible/60% Covered at 100% Deductible/60%

Emergency Room

Deductible/80% Network deductible/80% Deductible/80% Network

Deductible/80%

Inpatient Hospital

4 2017–18 Benefits Enrollment