Page 14 - Dentsu 2022 Annual Enrollment Flyer

P. 14

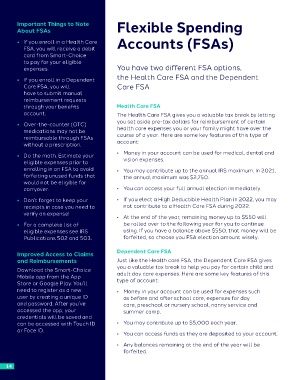

Important Things to Note Flexible Spending

About FSAs

• If you enroll in a Health Care Accounts (FSAs)

FSA, you will receive a debit

card from Smart-Choice

to pay for your eligible

expenses. You have two different FSA options,

• If you enroll in a Dependent the Health Care FSA and the Dependent

Care FSA, you will Care FSA

have to submit manual

reimbursement requests

through your benefits Health Care FSA

account. The Health Care FSA gives you a valuable tax break by letting

• Over-the-counter (OTC) you set aside pre-tax dollars for reimbursement of certain

medications may not be health care expenses you or your family might have over the

reimbursable through FSAs course of a year. Here are some key features of this type of

without a prescription. account:

• Do the math. Estimate your • Money in your account can be used for medical, dental and

eligible expenses prior to vision expenses.

enrolling in an FSA to avoid • You may contribute up to the annual IRS maximum. In 2021,

forfeiting unused funds that the annual maximum was $2,750.

would not be eligible for

carryover. • You can access your full annual election immediately.

• Don’t forget to keep your • If you elect a High Deductible Health Plan in 2022, you may

receipts in case you need to not contribute to a Health Care FSA during 2022.

verify an expense! • At the end of the year, remaining money up to $550 will

• For a complete list of be rolled over to the following year for you to continue

eligible expenses see IRS using. If you have a balance above $550, that money will be

Publications 502 and 503. forfeited, so choose you FSA election amount wisely.

Improved Access to Claims Dependent Care FSA

and Reimbursements Just like the Health care FSA, the Dependent Care FSA gives

Download the Smart-Choice you a valuable tax break to help you pay for certain child and

Mobile app from the App adult day care expenses. Here are some key features of this

Store or Google Play. You’ll type of account:

need to register as a new • Money in your account can be used for expenses such

user by creating a unique ID as before and after school care, expenses for day

and password. After you’ve care, preschool or nursery school, nanny service and

accessed the app, your summer camp.

credentials will be saved and

can be accessed with Touch ID • You may contribute up to $5,000 each year.

or Face ID. • You can access funds as they are deposited to your account.

• Any balances remaining at the end of the year will be

forfeited.

14 2022 Benefits Enrollment

About FSAs

• If you enroll in a Health Care Accounts (FSAs)

FSA, you will receive a debit

card from Smart-Choice

to pay for your eligible

expenses. You have two different FSA options,

• If you enroll in a Dependent the Health Care FSA and the Dependent

Care FSA, you will Care FSA

have to submit manual

reimbursement requests

through your benefits Health Care FSA

account. The Health Care FSA gives you a valuable tax break by letting

• Over-the-counter (OTC) you set aside pre-tax dollars for reimbursement of certain

medications may not be health care expenses you or your family might have over the

reimbursable through FSAs course of a year. Here are some key features of this type of

without a prescription. account:

• Do the math. Estimate your • Money in your account can be used for medical, dental and

eligible expenses prior to vision expenses.

enrolling in an FSA to avoid • You may contribute up to the annual IRS maximum. In 2021,

forfeiting unused funds that the annual maximum was $2,750.

would not be eligible for

carryover. • You can access your full annual election immediately.

• Don’t forget to keep your • If you elect a High Deductible Health Plan in 2022, you may

receipts in case you need to not contribute to a Health Care FSA during 2022.

verify an expense! • At the end of the year, remaining money up to $550 will

• For a complete list of be rolled over to the following year for you to continue

eligible expenses see IRS using. If you have a balance above $550, that money will be

Publications 502 and 503. forfeited, so choose you FSA election amount wisely.

Improved Access to Claims Dependent Care FSA

and Reimbursements Just like the Health care FSA, the Dependent Care FSA gives

Download the Smart-Choice you a valuable tax break to help you pay for certain child and

Mobile app from the App adult day care expenses. Here are some key features of this

Store or Google Play. You’ll type of account:

need to register as a new • Money in your account can be used for expenses such

user by creating a unique ID as before and after school care, expenses for day

and password. After you’ve care, preschool or nursery school, nanny service and

accessed the app, your summer camp.

credentials will be saved and

can be accessed with Touch ID • You may contribute up to $5,000 each year.

or Face ID. • You can access funds as they are deposited to your account.

• Any balances remaining at the end of the year will be

forfeited.

14 2022 Benefits Enrollment