Page 25 - Franklin Madison 2022 Benefits Guide

P. 25

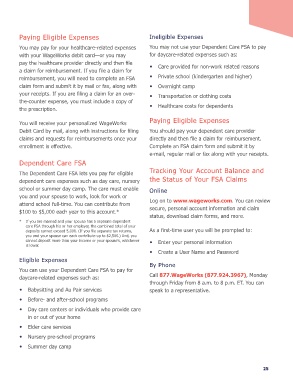

Paying Eligible Expenses Ineligible Expenses

You may pay for your healthcare-related expenses You may not use your Dependent Care FSA to pay

with your WageWorks debit card—or you may for daycare-related expenses such as:

pay the healthcare provider directly and then ile y Care provided for non-work related reasons

a claim for reimbursement. If you ile a claim for

reimbursement, you will need to complete an FSA y Private school (kindergarten and higher)

claim form and submit it by mail or fax, along with y Overnight camp

your receipts. If you are iling a claim for an over- y Transportation or clothing costs

the-counter expense, you must include a copy of

the prescription. y Healthcare costs for dependents

You will receive your personalized WageWorks Paying Eligible Expenses

Debit Card by mail, along with instructions for iling You should pay your dependent care provider

claims and requests for reimbursements once your directly and then ile a claim for reimbursement.

enrollment is efective. Complete an FSA claim form and submit it by

e-mail, regular mail or fax along with your receipts.

Dependent Care FSA

The Dependent Care FSA lets you pay for eligible Tracking Your Account Balance and

dependent care expenses such as day care, nursery the Status of Your FSA Claims

school or summer day camp. The care must enable Online

you and your spouse to work, look for work or

attend school full-time. You can contribute from Log on to www.wageworks.com. You can review

$100 to $5,000 each year to this account.* secure, personal account information and claim

status, download claim forms, and more.

* If you are married and your spouse has a separate dependent

care FSA through his or her employer, the combined total of your

deposits cannot exceed 5,000. (If you ile separate tax returns, As a irst-time user you will be prompted to:

you and your spouse can each contribute up to $2,500.) And, you

cannot deposit more than your income or your spouse’s, whichever y Enter your personal information

is lower.

y Create a User Name and Password

Eligible Expenses

You can use your Dependent Care FSA to pay for By Phone

daycare-related expenses such as: Call 877.WageWorks (877.924.3967), Monday

through Friday from 8 a.m. to 8 p.m. ET. You can

y Babysitting and Au Pair services speak to a representative.

y Before- and after-school programs

y Day care centers or individuals who provide care

in or out of your home

y Elder care services

y Nursery pre-school programs

y Summer day camp

25

You may pay for your healthcare-related expenses You may not use your Dependent Care FSA to pay

with your WageWorks debit card—or you may for daycare-related expenses such as:

pay the healthcare provider directly and then ile y Care provided for non-work related reasons

a claim for reimbursement. If you ile a claim for

reimbursement, you will need to complete an FSA y Private school (kindergarten and higher)

claim form and submit it by mail or fax, along with y Overnight camp

your receipts. If you are iling a claim for an over- y Transportation or clothing costs

the-counter expense, you must include a copy of

the prescription. y Healthcare costs for dependents

You will receive your personalized WageWorks Paying Eligible Expenses

Debit Card by mail, along with instructions for iling You should pay your dependent care provider

claims and requests for reimbursements once your directly and then ile a claim for reimbursement.

enrollment is efective. Complete an FSA claim form and submit it by

e-mail, regular mail or fax along with your receipts.

Dependent Care FSA

The Dependent Care FSA lets you pay for eligible Tracking Your Account Balance and

dependent care expenses such as day care, nursery the Status of Your FSA Claims

school or summer day camp. The care must enable Online

you and your spouse to work, look for work or

attend school full-time. You can contribute from Log on to www.wageworks.com. You can review

$100 to $5,000 each year to this account.* secure, personal account information and claim

status, download claim forms, and more.

* If you are married and your spouse has a separate dependent

care FSA through his or her employer, the combined total of your

deposits cannot exceed 5,000. (If you ile separate tax returns, As a irst-time user you will be prompted to:

you and your spouse can each contribute up to $2,500.) And, you

cannot deposit more than your income or your spouse’s, whichever y Enter your personal information

is lower.

y Create a User Name and Password

Eligible Expenses

You can use your Dependent Care FSA to pay for By Phone

daycare-related expenses such as: Call 877.WageWorks (877.924.3967), Monday

through Friday from 8 a.m. to 8 p.m. ET. You can

y Babysitting and Au Pair services speak to a representative.

y Before- and after-school programs

y Day care centers or individuals who provide care

in or out of your home

y Elder care services

y Nursery pre-school programs

y Summer day camp

25