Page 357 - @Annual Report_PLN Batam__2019_Lowress_Neat

P. 357

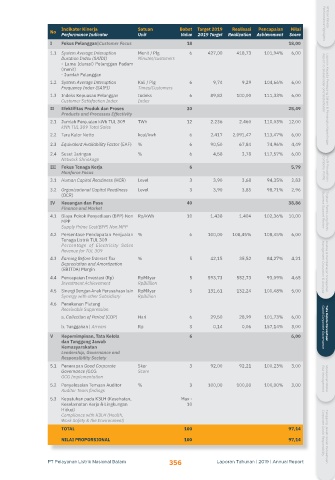

Indikator Kinerja Satuan Bobot Target 2019 Realisasi Pencapaian Nilai Performance Highlights Ikhtisar Kinerja

No

Performance Indicator Unit Value 2019 Target Realization Achievement Score

I Fokus Pelanggan|Customer Focus 18 18,00

1.1 System Average Interuption Menit / Plg 6 427,00 418,73 101,94% 6,00

Duration Index (SAIDI) Minutes/customers

- Lama (durasi) Pelanggan Padam

(menit)

- Jumlah Pelanggan

1.2 System Average Interuption Kali / Plg 6 9,74 9,29 104,66% 6,00 Report to Shareholder and Stakeholder

Frequency Index (SAIFI) Times/Customers

1.3 Indeks Kepuasan Pelanggan Indeks 6 89,82 100,00 111,33% 6,00

Customer Satisfaction Index Index Laporan Kepada Pemegang Saham & Pemangku Kepentingan

II Efektifitas Produk dan Proses 30 28,49

Products and Processes Effectivity

2.1 Jumlah Penjualan kWh TUL 309 TWh 12 2.236 2.460 110,03% 12,00

kWh TUL 309 Total Sales

2.2 Tara Kalor Netto kcal/kwh 6 2.417 2.091,47 113,47% 6,00

2.3 Equivalent Availability Factor (EAF) % 6 90,50 67,84 74,96% 4,49

2.4 Susut Jaringan % 6 4,58 3,78 117,57% 6,00

Network Shrinkage

III Fokus Tenaga Kerja 6 5,79 Company Profile

Manforce Focus Profil Perusahaan

3.1 Human Capital Readiness (HCR) Level 3 3,90 3,68 94,35% 2,83

3.2 Organizational Capital Readiness Level 3 3,90 3,85 98,71% 2,96

(OCR)

IV Keuangan dan Pasa 40 38,86

Finance and Market Business Support Review

4.1 Biaya Pokok Penyediaan (BPP) Non Rp/kWh 10 1.438 1.404 102,36% 10,00 Tinjauan Pendukung Bisnis

MPP

Supply Prime Cost(BPP) Non MPP

4.2 Persentase Pendapatan Penjualan % 6 100,00 108,45% 108,45% 6,00

Tenaga Listrik TUL 309

Percentage of Electricity Sales

Revenue for TUL 309

4.3 Earning Before Interset Tax % 5 42,15 35,52 84,27% 4,21

Depreciation and Amortization

(EBITDA) Margin Management Discussion & Analysis Analisa & Pembahasan Manajemen

4.4 Pencapaian Investasi (Rp) RpMilyar 5 593,73 552,73 93,09% 4,65

Investment Achievement RpBilllion

4.5 Sinergi Dengan Anak Perusahaan lain RpMilyar 5 131,61 132,24 100,48% 5,00

Synergy with other Subsidiary RpBillion

4.6 Penekanan Piutang

Receivable Suppression

a. Collection of Period (COP) Hari 6 29,50 28,99 101,73% 6,00

b. Tunggakan | Arrears Rp 3 0,14 0,06 157,14% 3,00 Good Corporate Governance Tata Kelola Perusahaan

V Kepemimpinan, Tata Kelola 6 6,00

dan Tanggung Jawab

Kemasyarakatan

Leadership, Governance and

Responsibility Society

5.1 Penerapan Good Corporate Skor 3 92,00 92,21 100,23% 3,00

Governance (GCG Score

GCG Implementation Risk Management Manajemen Risiko

5.2 Penyelesaian Temuan Auditor % 3 100,00 100,00 100,00% 3,00

Auditor Team findings

5.3 Kepatuhan pada K3LH (Kesehatan, Max -

Keselamatan Kerja & Lingkungan 10

Hidup)

Compliance with K3LH (Health,

Work Safety & the Environment)

TOTAL 100 97,14 Corporate Social Responsibility

NILAI PROPORSIONAL 100 97,14 Tanggung Jawab Sosial Perusahaan

PT Pelayanan Listrik Nasional Batam 356 Laporan Tahunan | 2019 | Annual Report