Page 9 - Desert Oracle May 2020

P. 9

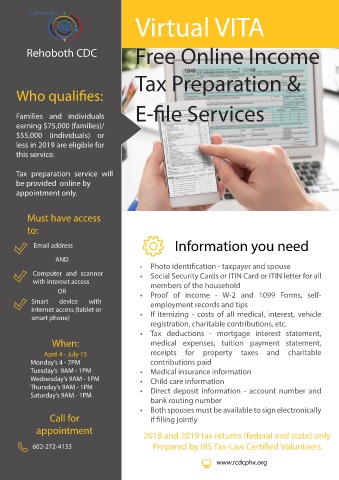

Virtual VITA

Rehoboth CDC Free Online Income

Tax Preparation &

Who qualifies:

E-file Services

Families and individuals

earning $75,000 (families)/

$55,000 (individuals) or

less in 2019 are eligible for

this service.

Tax preparation service will

be provided online by

appointment only.

Must have access

to:

Information you need

Email address

AND

• Photo identification - taxpayer and spouse

Computer and scanner • Social Security Cards or ITIN Card or ITIN letter for all

with internet access members of the household

OR • Proof of income - W-2 and 1099 Forms, self-

Smart device with employment records and tips

internet access (tablet or

smart phone) • If itemizing - costs of all medical, interest, vehicle

registration, charitable contributions, etc.

• Tax deductions - mortgage interest statement,

When: medical expenses, tuition payment statement,

April 4 - July 15 receipts for property taxes and charitable

Monday’s 4 - 7PM contributions paid

Tuesday’s 9AM - 1PM • Medical insurance information

Wednesday’s 9AM - 1PM • Child care information

Thursday’s 9AM - 1PM • Direct deposit information - account number and

Saturday’s 9AM - 1PM

bank routing number

• Both spouses must be available to sign electronically

Call for if filling jointly

appointment

2018 and 2019 tax returns (federal and state) only

602-272-4133 Prepared by IRS Tax-Law Certified Volunteers

www.rcdcphx.org