Page 7 - Florida Aquarium Benefits-at-a-Glance Guide 2022-2023

P. 7

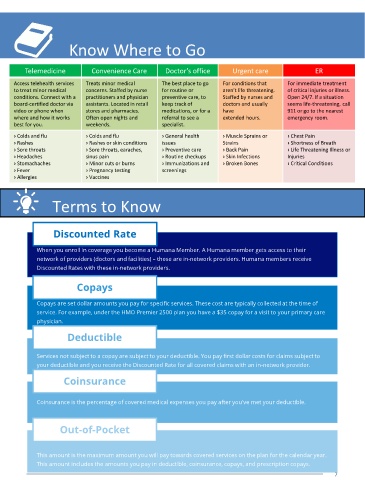

Know Where to Go

Telemedicine Convenience Care Doctor’s office Urgent care ER

Access telehealth services Treats minor medical The best place to go For conditions that For immediate treatment

to treat minor medical concerns. Staffed by nurse for routine or aren’t life threatening. of critical injuries or illness.

conditions. Connect with a practitioners and physician preventive care, to Staffed by nurses and Open 24/7. If a situation

board-certified doctor via assistants. Located in retail keep track of doctors and usually seems life-threatening, call

video or phone when stores and pharmacies. medications, or for a have 911 or go to the nearest

where and how it works Often open nights and referral to see a extended hours. emergency room.

best for you. weekends. specialist.

› Colds and flu › Colds and flu › General health › Muscle Sprains or › Chest Pain

› Rashes › Rashes or skin conditions issues Strains › Shortness of Breath

› Sore throats › Sore throats, earaches, › Preventive care › Back Pain › Life Threatening Illness or

› Headaches sinus pain › Routine checkups › Skin Infections Injuries

› Stomachaches › Minor cuts or burns › Immunizations and › Broken Bones › Critical Conditions

› Fever › Pregnancy testing screenings

› Allergies › Vaccines

Terms to Know

Discounted Rate

When you enroll in coverage you become a Humana Member. A Humana member gets access to their

network of providers (doctors and facilities) – these are in-network providers. Humana members receive

Discounted Rates with these in-network providers.

Copays

Copays are set dollar amounts you pay for specific services. These cost are typically collected at the time of

service. For example, under the HMO Premier 2500 plan you have a $35 copay for a visit to your primary care

physician.

Deductible

Services not subject to a copay are subject to your deductible. You pay first dollar costs for claims subject to

your deductible and you receive the Discounted Rate for all covered claims with an in-network provider.

Coinsurance

Coinsurance is the percentage of covered medical expenses you pay after you've met your deductible.

Out-of-Pocket

This amount is the maximum amount you will pay towards covered services on the plan for the calendar year.

This amount includes the amounts you pay in deductible, coinsurance, copays, and prescription copays.

7