Page 15 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 15

13

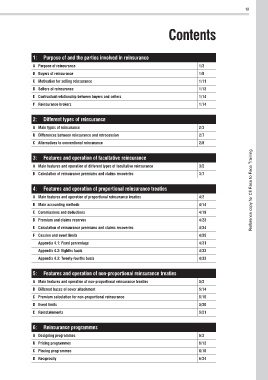

Contents

1: Purpose of and the parties involved in reinsurance

A Purpose of reinsurance 1/2

B Buyers of reinsurance 1/8

C Motivation for selling reinsurance 1/11

D Sellers of reinsurance 1/12

E Contractual relationship between buyers and sellers 1/14

F Reinsurance brokers 1/14

2: Different types of reinsurance

A Main types of reinsurance 2/3

B Differences between reinsurance and retrocession 2/7

C Alternatives to conventional reinsurance 2/8

3: Features and operation of facultative reinsurance

A Main features and operation of different types of facultative reinsurance 3/2

B Calculation of reinsurance premiums and claims recoveries 3/7

4: Features and operation of proportional reinsurance treaties Reference copy for CII Face to Face Training

A Main features and operation of proportional reinsurance treaties 4/2

B Main accounting methods 4/14

C Commissions and deductions 4/19

D Premium and claims reserves 4/23

E Calculation of reinsurance premiums and claims recoveries 4/24

F Cession and event limits 4/25

Appendix 4.1: Fixed percentage 4/31

Appendix 4.2: Eighths basis 4/32

Appendix 4.3: Twenty-fourths basis 4/33

5: Features and operation of non-proportional reinsurance treaties

A Main features and operation of non-proportional reinsurance treaties 5/2

B Different bases of cover attachment 5/14

C Premium calculation for non-proportional reinsurance 5/15

D Event limits 5/20

E Reinstatements 5/21

6: Reinsurance programmes

A Designing programmes 6/2

B Pricing programmes 6/12

C Placing programmes 6/16

D Reciprocity 6/24