Page 16 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 16

14 M97/February 2018 Reinsurance

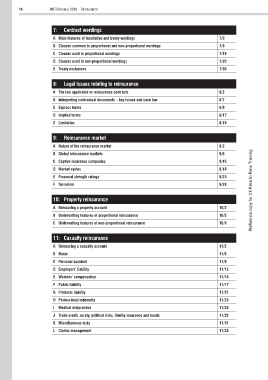

7: Contract wordings

A Main features of facultative and treaty wordings 7/3

B Clauses common to proportional and non-proportional wordings 7/9

C Clauses used in proportional wordings 7/19

D Clauses used in non-proportional wordings 7/25

E Treaty exclusions 7/39

8: Legal issues relating to reinsurance

A The law applicable to reinsurance contracts 8/2

B Interpreting contractual documents – key issues and case law 8/7

C Express terms 8/9

D Implied terms 8/17

E Limitation 8/19

9: Reinsurance market

A Nature of the reinsurance market 9/2

B Global reinsurance markets 9/6

C Captive insurance companies 9/15

D Market cycles 9/19

E Financial strength ratings 9/24

F Terrorism 9/28 Reference copy for CII Face to Face Training

10: Property reinsurance

A Reinsuring a property account 10/2

B Underwriting features of proportional reinsurance 10/5

C Underwriting features of non-proportional reinsurance 10/8

11: Casualty reinsurance

A Reinsuring a casualty account 11/2

B Motor 11/6

C Personal accident 11/9

D Employers’ liability 11/12

E Workers’ compensation 11/14

F Public liability 11/17

G Products liability 11/21

H Professional indemnity 11/23

I Medical malpractice 11/24

J Trade credit, surety, political risks, fidelity insurance and bonds 11/25

K Miscellaneous risks 11/31

L Claims management 11/33