Page 280 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 280

10/12 M97/February 2018 Reinsurance

Table 10.2: Claims recoveries

Building Sum insured Loss Reinsurance recovery

A £500,000 £350,000 £250,000

B £500,000 £400,000 £300,000

C £250,000 £250,000 £150,000

D £750,000 £750,000 £400,000

E £450,000 £400,000 £300,000

F £600,000 £600,000 £400,000

G £600,000 £500,000 £400,000

£2,200,000

However, if an event limit of four times the one risk limit of £400,000 is included, the recoveries are

limited to £1.6m. In that situation the reinsured has to meet the difference between £1.6m and the

£2.2m that it would have been able to recover without that limitation. This is, of course, in addition to its

own retention of £100,000 for each individual risk.

The reinsured will still be faced with the possibility of numerous losses arising out of one event. Many of

them will be below the retention of the per risk excess of loss cover. This type of treaty, with or without

an event limit, may be of value in the design of a reinsurance programme by inuring to the benefit of

catastrophe excess of loss covers.

C3 Catastrophe excess of loss

A non-proportional treaty can be arranged on what is known as an event or catastrophe basis. In

property reinsurance the catastrophe excess of loss cover is usually placed to protect a reinsured’s net

account, this being the amount of exposure retained after laying off risk to other reinsurances. In marine

reinsurance, by contrast, excess of loss usually protects an account on a per risk and catastrophe basis. Reference copy for CII Face to Face Training

Example 10.4

An insurer is covering the peril of windstorm. A hurricane causes damage over a widespread area and the insurer is

faced with claims from thousands of property owners, including shops, homes, farms, hospitals, schools, offices,

warehouses and manufacturing businesses, many of whom would have been well within the reinsured’s retention in

respect of any one risk. The total cost to the insurer is vast. However, the reinsured has arranged a catastrophe

non-proportional treaty providing cover for £2m excess of £1m any one loss occurrence, allowing the insurer to

underwrite risks up to a capacity of £3m in total to cover the MPL in one area.

In the event of a major catastrophe causing a total loss to the cover, the reinsured pays for the total of

the individual losses and recovers up to the limit of £2m. The MPL may be regarded as higher than this

figure and insurers may therefore also buy additional cover ‘in layers’ above the first level of

non-proportional cover. Figure 10.2 illustrates this arrangement.

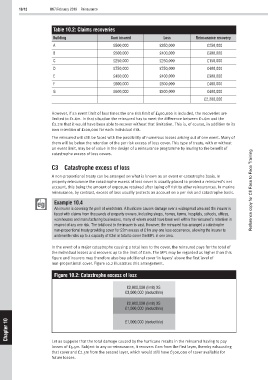

Figure 10.2: Catastrophe excess of loss

£3,000,000 (limit) XS

£3,000,000 (deductible)

£2,000,000 (limit) XS

£1,000,000 (deductible)

10 £1,000,000 (deductible)

Chapter

Let us suppose that the total damage caused by the hurricane results in the reinsured having to pay

losses of £5.5m. Subject to any co-reinsurance, it recovers £2m from the first layer, thereby exhausting

that cover and £2.5m from the second layer, which would still have £500,000 of cover available for

future losses.