Page 291 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 291

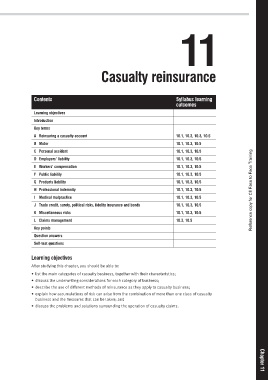

11

Casualty reinsurance

Contents Syllabus learning

outcomes

Learning objectives

Introduction

Key terms

A Reinsuring a casualty account 10.1, 10.2, 10.3, 10.5

B Motor 10.1, 10.3, 10.5

C Personal accident 10.1, 10.3, 10.5

D Employers’ liability 10.1, 10.3, 10.5

E Workers’ compensation 10.1, 10.3, 10.5

F Public liability 10.1, 10.3, 10.5

G Products liability 10.1, 10.3, 10.5

H Professional indemnity 10.1, 10.3, 10.5 Reference copy for CII Face to Face Training

I Medical malpractice 10.1, 10.3, 10.5

J Trade credit, surety, political risks, fidelity insurance and bonds 10.1, 10.3, 10.5

K Miscellaneous risks 10.1, 10.3, 10.5

L Claims management 10.3, 10.5

Key points

Question answers

Self-test questions

Learning objectives

After studying this chapter, you should be able to:

• list the main categories of casualty business, together with their characteristics;

• discuss the underwriting considerations for each category of business;

• describe the use of different methods of reinsurance as they apply to casualty business;

• explain how accumulations of risk can arise from the combination of more than one class of casualty

business and the measures that can be taken; and

• discuss the problems and solutions surrounding the operation of casualty claims. Chapter

11