Page 296 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 296

11/6 M97/February 2018 Reinsurance

B Motor

Since motor third-party liability (MTPL) and motor own damage (MOD) business accounts in many cases

Results are of crucial

significance for the for more than 50% of primary insurance premiums in the non-life segment, its results are of crucial

primary insurer’s significance for the primary insurer’s business success. Such an important class of business also places

business

special demands on the reinsurer and consequently needs to be handled with great care.

B1 Interests of primary insurers/reinsurers

When first entering a market segment, or developing a new product, a primary insurer will generally

prefer a quota share treaty.

Question 11.1

Why would excess of loss not represent an equally valid choice for such an insurer?

When, on the other hand, business is yielding good results, primary insurers have an interest in reducing

quota shares in order to retain more of the premium income themselves. The reinsurer must be careful of

engaging in ‘pre-financing’ in the form of quota shares and incurring corresponding initial losses, unless

there are good prospects for a mutually long-term arrangement which would be of benefit to both

parties.

B2 Extent of cover and exclusions

In motor insurance, three different types of cover with entirely different contents are offered:

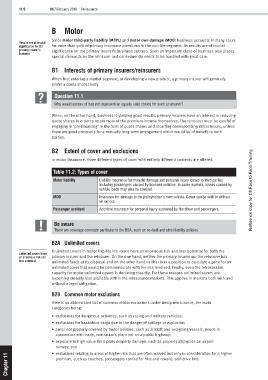

Table 11.2: Types of cover

Motor liability Liability insurance for material damage and personal injury losses to third parties

including passengers caused by licensed vehicles. In some markets, losses caused by

vehicle loads may also be covered. Reference copy for CII Face to Face Training

MOD Insurance for damage to the policyholder’s own vehicle. Cover can be with or without

an excess.

Passenger accident Accident insurance for personal injury sustained by the driver and passengers.

Be aware

There are coverage concepts particular to the USA, such as no-fault and strict liability policies.

B2A Unlimited covers

Unlimited covers in motor liability insurance have an enormous risk and loss potential for both the

Unlimited covers have

an enormous risk and primary insurer and the reinsurer. On the one hand, neither the primary insurer nor the reinsurer has

loss potential unlimited funds at its disposal and on the other hand neither is in a position to calculate a price for an

unlimited cover that would be commensurate with the risk involved. Finally, even the retrocession

capacity for motor unlimited covers is declining steadily. For these reasons unlimited covers are

becoming steadily less available within the reinsurance markets. This applies in markets both with and

without a legal obligation.

B2B Common motor exclusions

Here is an abbreviated list of common motor exclusions under treaty reinsurance, the main

categories being:

• exclusions for dangerous activities, such as racing and military vehicles;

• exclusions for hazardous cargo due to the danger of spillage or explosion;

• areas not properly covered by motor policies, such as aircraft and sea-going vessels, goods in

connection with trade, contractor’s plant not on a public highway;

• exposure to high-value third-party property damage, such as property alongside an airport

runway; and

11 • exclusions relating to areas of higher risk that are often waived but only in consideration for a higher

premium, such as coaches, passengers carried for hire and reward, self-drive hire.

Chapter