Page 292 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 292

11/2 M97/February 2018 Reinsurance

Introduction

‘Casualty’ is a term that originated in the USA and is now used to describe both US and international

business. It is closely aligned to the UK term ‘liability’ and the two are interchangeable. Liability as a

class refers to those forms of insurance which indemnify the ‘first’, or insured party, in the event that it is

legally liable to pay compensation to a third party. Liability can be established in court, through

arbitration or through negotiation between the lawyers for either side which, in the end, stops short of a

court appearance.

Note: when limits of indemnity and legal requirements are considered in the following sections, these

relate to English practice.

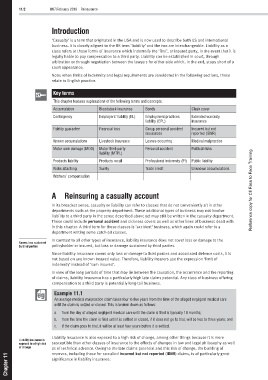

Key terms

This chapter features explanations of the following terms and concepts:

Accumulation Bloodstock insurance Bonds Clash cover

Contingency Employers’ liability (EL) Employment practices Extended warranty

liability (EPL) insurance

Fidelity guarantee Financial loss Group personal accident Incurred but not

insurances reported (IBNR)

Known accumulations Livestock insurance Losses occurring Medical malpractice

Motor own damage (MOD) Motor third-party Personal accident Political risks

liability (MTPL)

Products liability Products recall Professional indemnity (PI) Public liability

Risks attaching Surety Trade credit Unknown accumulations

Workers’ compensation

A Reinsuring a casualty account Reference copy for CII Face to Face Training

In its broadest sense, casualty or liability can refer to classes that do not conveniently sit in other

departments such as the property department. These additional types of business may not involve

liability to a third party in the sense described above yet may still be written in the casualty department.

These could include personal accident and sickness covers as well as other lines of business dealt with

in this chapter. A third term for these classes is ‘accident’ business, which again could refer to a

department writing some catch-all classes.

In contrast to all other types of insurance, liability insurance does not cover loss or damage to the

Covers loss sustained

by third parties policyholder or insured, but loss or damage sustained by third parties.

Since liability insurance covers only loss or damage to third parties and associated defence costs, it is

not based on any known insured value. Therefore, liability insurers use the expression ‘limit of

indemnity’ instead of ‘sum insured’.

In view of the long periods of time that may lie between the causation, the occurrence and the reporting

of claims, liability insurance has a particularly high late claims potential. Any class of business offering

compensation to a third party is potentially long-tail business.

Example 11.1

An average medical malpractice claim takes four to five years from the time of the alleged negligent medical care

until the claim is settled or closed. This is broken down as follows:

a. from the day of alleged negligent medical care until the claim is filed is typically 18 months;

b. from the time the claim is filed until it is settled or closed, if it does not go to trial, will be two to three years; and

c. if the claim goes to trial, it will be at least four years before it is settled.

Liability insurance is also exposed to a high risk of change, among other things because it is more

Liability insurance is

exposed to a high risk susceptible than other classes of insurance to the effects of changes in law and legal philosophy as well

of change as of technical advance. Owing to the late claims potential and this risk of change, the building of

11 reserves, including those for so-called incurred but not reported (IBNR) claims, is of particularly great

significance in liability insurance.

Chapter